Subheading: Understanding Discounted Insurance Rates

Discounted insurance rates are more than just cost reductions; they represent an opportunity for individuals and businesses to secure comprehensive coverage while saving money. Understanding the factors influencing these discounts and how they can benefit you is crucial.

Factors Affecting Discounts: Comprehensive Analysis

Several factors influence discounted insurance rates. These include a clean driving record for auto insurance, a healthy lifestyle for health insurance, security measures for property insurance, and a favorable claims history for business insurance. Analyzing these factors helps individuals understand their eligibility for discounts.

Safe Driving and Discounts: Auto Insurance

For auto insurance, safe driving plays a pivotal role in securing discounted rates. Maintaining a clean driving record, attending defensive driving courses, and installing safety features in vehicles can qualify individuals for reduced premiums, reflecting their lower risk of accidents.

Health and Lifestyle: Discounted Health Insurance

Health insurance discounts often stem from healthy lifestyle choices. Non-smokers, regular exercisers, and individuals with balanced diets often receive discounted rates. These measures not only promote well-being but also result in potential savings on health insurance premiums.

Property Security Measures: Home Insurance Savings

Discounted rates in home insurance are often associated with security measures. Installing burglar alarms, fire extinguishers, or enhancing home safety with reinforced doors and windows can significantly lower insurance premiums, reflecting reduced risks.

Business Claims History: Insurance Savings

Business insurance discounts are influenced by a positive claims history. Companies with minimal claims or robust risk management practices are perceived as lower risk, making them eligible for discounted rates on various insurance policies.

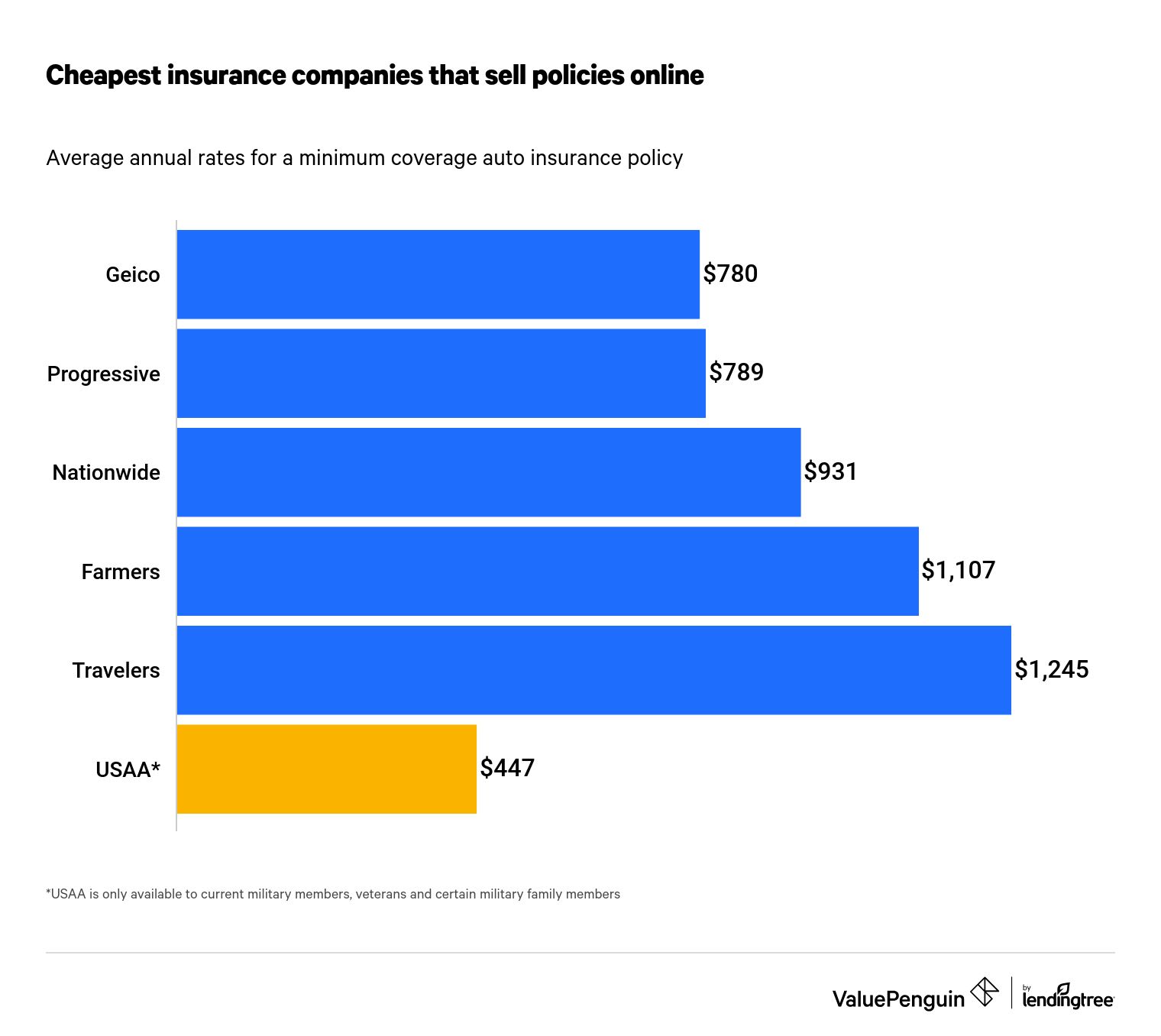

Exploring Discount Opportunities: Comparison Shopping

Comparing insurance providers is crucial in exploring discount opportunities. Different insurers offer various discounts based on their criteria. Platforms like Discounted Insurance Rates provide insights into available discounts, aiding individuals in finding the most suitable coverage at reduced rates.

Discount Bundling: Maximizing Savings

Many insurers offer discounts for bundling multiple policies. Combining auto, home, and life insurance, for instance, with the same provider often results in discounted rates across policies, maximizing savings for policyholders.

Regular Review and Negotiation: Ensuring Discounts

Regularly reviewing insurance policies and negotiating rates is essential. Life changes, such as marriage, career advancements, or improved credit scores, might warrant reevaluation, potentially leading to additional discounts.

Understanding Policy Limits: Balancing Savings and Coverage

While discounted rates are attractive, it’s crucial to understand policy limits. Lower premiums might sometimes mean reduced coverage or higher deductibles. Balancing savings with adequate coverage ensures financial protection during unforeseen events.

Conclusion: Securing Comprehensive Coverage at Reduced Rates

Discounted insurance rates offer an opportunity to secure comprehensive coverage while saving money. From safe driving habits to healthy lifestyles, enhanced security measures, and smart comparison shopping, understanding and leveraging discounts can result in significant savings across various insurance policies.

For those seeking discounted insurance rates tailored to their needs, explore options at Discounted Insurance Rates. This platform offers insights into available discounts, facilitating informed decisions to secure comprehensive coverage at reduced rates.

You may also like

Table of Contents

ToggleCategories

Recent Posts

- The Role of Tradition in German Royal Engagement Ring Design

- Battle of the Additives: Comparing B12 Chemtool and Seafoam for Engine Care

- The Ultimate Guide to Auto Repair: Everything You Need to Know

- Virtual Assistant Medical Billing: A Modern Approach to Healthcare Finances

- The Journey Through ABA Therapy in Baltimore: What to Know

- Total visitors : 7,441

- Total page views: 12,664

Archives

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- February 2024

- January 2024

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017