Understanding Affordable Insurance

Affordable insurance policies offer crucial financial protection without straining your budget. These policies are designed to provide necessary coverage at reasonable premiums, ensuring individuals and families have access to essential protection without excessive financial burden.

Factors Influencing Affordability

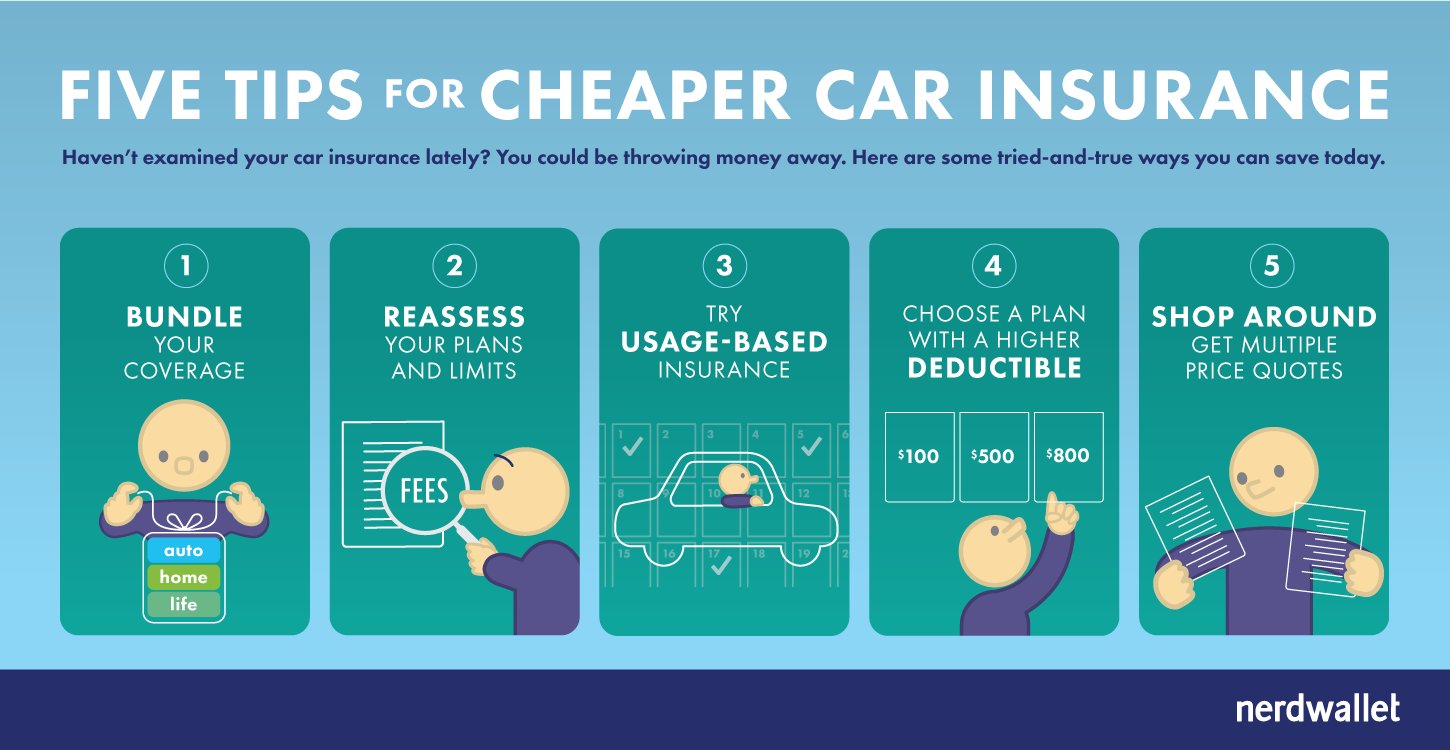

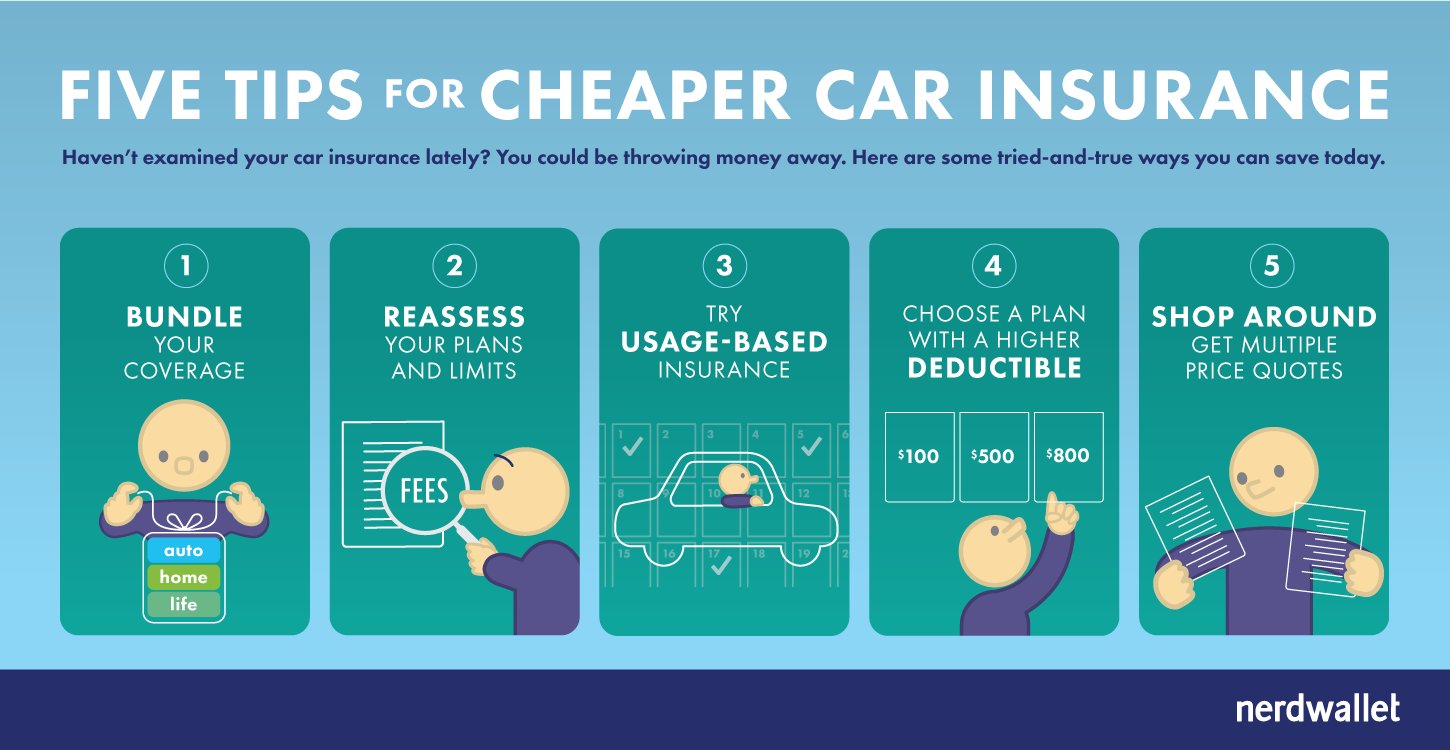

Several factors contribute to the affordability of insurance policies. These include coverage limits, deductibles, the type of coverage needed, and the individual’s risk profile. Understanding these factors helps in selecting a policy that strikes a balance between affordability and adequate coverage.

Types of Affordable Insurance Policies

Numerous types of insurance policies are available at affordable rates. These can range from health and life insurance to auto and homeowners’ insurance. Each policy type offers varying levels of coverage and premiums, catering to different needs and budgets.

Subheading 4: Importance of Comparison Shopping

Comparing insurance policies from different providers is key to finding the most affordable options. This involves reviewing coverage details, premiums, deductibles, and additional benefits offered by various insurers. Platforms like OffRoadTaxi.net provide comprehensive insights to facilitate informed comparison shopping.

Assessing Individual Needs

Tailoring insurance policies to individual needs is essential for affordability. Assessing the specific risks, necessities, and financial capabilities helps in selecting a policy that covers essential areas while remaining within budget constraints.

Balancing Cost and Coverage

Striking a balance between cost and coverage is pivotal when opting for affordable insurance policies. While it’s tempting to select the cheapest policy available, ensuring adequate coverage for potential risks is equally important. Affordable policies should offer reasonable coverage without compromising essential protections.

Utilizing Discounts and Savings

Insurance providers often offer discounts or savings opportunities that can make policies more affordable. These discounts can be based on factors like good driving records, bundled policies, or installing safety features. Exploring available discounts can significantly reduce insurance costs.

Understanding Policy Terms

Thoroughly understanding the terms and conditions of an insurance policy is vital. This includes grasping the coverage details, exclusions, renewal terms, and cancellation policies. Clarity on these aspects prevents surprises and ensures full utilization of the policy benefits.

Seeking Professional Advice

When navigating the complexities of insurance policies, seeking advice from insurance professionals can be beneficial. Insurance agents or brokers can provide insights, answer questions, and offer guidance in finding affordable policies tailored to individual needs.

Conclusion

In conclusion, affordable insurance policies are crucial for financial security while maintaining a budget. By understanding the factors influencing affordability, comparing policies, and customizing coverage to personal needs, individuals can secure necessary protection without overextending financially. Explore OffRoadTaxi.net for comprehensive insights into affordable insurance policies and find the right coverage within your budget.

Subheading: Understanding the Importance of Affordable Insurance Premiums

In today’s fast-paced world, securing insurance coverage is more than a safety net; it’s a necessity. However, finding the right coverage that doesn’t break the bank can be a challenge. Affordable insurance premiums provide a crucial balance between financial security and budget constraints, offering individuals and businesses the opportunity to protect themselves without compromising their financial stability.

The Role of Affordable Insurance Premiums

Affordable insurance premiums play a pivotal role in ensuring that individuals and businesses can access necessary coverage without overextending their finances. They serve as a gateway to various insurance policies, including health, auto, home, and business insurance, enabling a diverse range of people to safeguard their interests.

The Impact on Financial Planning

One of the key advantages of affordable insurance premiums is their positive impact on financial planning. By securing insurance at reasonable costs, individuals can better allocate their resources. This allows for a more comprehensive financial strategy, reducing the risk of unforeseen expenses and providing a safety cushion in times of need.

Navigating the Market for Affordable Premiums

With the burgeoning insurance market, navigating the myriad of options available can be overwhelming. However, taking the time to compare various policies and premiums ensures that individuals can find the most suitable coverage at a price that aligns with their budget.

Affordable Premiums: A Link to Security

Affordable insurance premiums serve as a link to security, offering a pathway for individuals and businesses to safeguard their assets and well-being. Whether it’s ensuring access to quality healthcare, protecting vehicles and properties, or securing businesses against unforeseen risks, these premiums are the foundation upon which a secure future is built.

The Need for Reliable Insurance Providers

While affordability is a crucial factor, the reliability of insurance providers cannot be overlooked. Partnering with reputable insurance companies ensures not only competitive premiums but also reliable coverage when it matters the most. Establishing trust with insurance providers is essential for a seamless claims process and dependable support.

Closing Thoughts

Affordable insurance premiums are more than just a cost-saving measure; they represent a pathway to security and peace of mind. By carefully considering options, understanding the coverage needed, and partnering with reliable providers, individuals and businesses can secure their futures without compromising their financial stability. It’s about striking the right balance between cost and coverage to ensure protection without undue financial strain.

For those seeking affordable insurance premiums tailored to their needs, consider exploring options at Affordable Insurance Premiums. This platform offers a range of insurance solutions designed to fit various budgets and requirements, helping individuals and businesses find the right coverage without compromising financial stability.

Categories

Recent Posts

- Hire Java Developers: Your Guide to Finding Top Talent

- 4 Tips to Introduce Poultry Grit to Your Chicks and Adult Birds the Right Way

- The Role of Tradition in German Royal Engagement Ring Design

- Battle of the Additives: Comparing B12 Chemtool and Seafoam for Engine Care

- The Ultimate Guide to Auto Repair: Everything You Need to Know

- Total visitors : 0

- Total page views: 0

Archives

- April 2025

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- February 2024

- January 2024

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017