Exploring the Future of Eco-Friendly Driving

The Rise of Electric SUVs

In recent years, the automotive industry has witnessed a remarkable shift towards sustainability and eco-consciousness. One of the most significant manifestations of this trend is the rise of electric SUVs. These vehicles represent a bold step towards reducing carbon emissions and minimizing environmental impact without compromising on performance or style.

Volvo’s Commitment to Sustainability

At the forefront of this movement is Volvo, a renowned automotive manufacturer known for its commitment to safety and innovation. With the introduction of its electric SUV lineup, Volvo is setting new standards for eco-friendly driving. By harnessing cutting-edge technology and sustainable design principles, Volvo’s electric SUVs offer drivers a greener alternative to traditional gas-powered vehicles.

Efficiency and Performance

One of the key advantages of Volvo’s electric SUVs is their exceptional efficiency and performance. Equipped with powerful electric motors and advanced battery systems, these vehicles deliver impressive acceleration and responsive handling. Whether navigating city streets or embarking on long-distance journeys, Volvo’s electric SUVs offer a smooth and exhilarating driving experience without the need for gasoline.

Zero Emissions, Zero Compromises

Perhaps the most compelling aspect of Volvo’s electric SUVs is their ability to operate with zero emissions. By running entirely on electricity, these vehicles eliminate harmful pollutants and reduce greenhouse gas emissions, making them a cleaner and more sustainable choice for drivers who are committed to minimizing their carbon footprint. With Volvo’s electric SUVs, eco-friendly driving has never been more accessible or enjoyable.

Innovative Technology

Volvo’s electric SUVs are packed with innovative technology designed to enhance efficiency, convenience, and safety on the road. From regenerative braking systems that capture and store energy during deceleration to intuitive infotainment interfaces that keep drivers connected and informed, these vehicles are equipped with a host of features that elevate the driving experience while minimizing environmental impact.

Charging Infrastructure

One of the challenges of electric vehicle ownership is access to charging infrastructure. Recognizing this, Volvo has invested in expanding its network of charging stations to make it easier for drivers to recharge their electric SUVs on the go. With a growing number of fast-charging stations located strategically across the country, Volvo is empowering drivers to embrace eco-friendly driving with confidence and convenience.

The Future of Mobility

As we look ahead, Volvo’s electric SUVs are poised to play a significant role in shaping the future of mobility. With ongoing advancements in battery technology and increasing consumer demand for sustainable transportation options, the market for electric vehicles is expected to continue growing. By leading the charge towards electrification, Volvo is demonstrating its commitment to driving positive change and preserving the planet for future generations.

Driving Towards a Greener Tomorrow

In conclusion, Volvo’s electric SUVs represent a compelling solution for drivers who are passionate about sustainability and eco-friendly driving. With their efficient performance, zero emissions, and innovative technology, these vehicles offer a glimpse into a future where mobility is cleaner, greener, and more sustainable. By embracing Volvo’s electric SUVs, drivers can embark on a journey towards a greener tomorrow while enjoying all the benefits of electric driving today. Read more about volvo electric suv

Introduction:

In a world where environmental concerns are at the forefront of our minds, the need for eco-friendly transportation has never been more critical. Enter the Kia Niro, a vehicle that is revolutionizing the way we think about driving. With its efficient design and eco-conscious features, the Kia Niro is redefining what it means to drive green.

Efficiency at its Core:

At the heart of the Kia Niro is its commitment to efficiency. Unlike traditional gas-guzzling vehicles, the Niro boasts a hybrid powertrain that seamlessly combines a gasoline engine with an electric motor. This innovative system allows the Niro to achieve impressive fuel economy ratings without sacrificing performance.

Sustainable Materials:

But efficiency isn’t just about what’s under the hood – it’s also about the materials used to build the vehicle. Kia has gone to great lengths to ensure that the Niro is as eco-friendly as possible, incorporating sustainable materials wherever they can. From recycled plastics to renewable bamboo fibers, every aspect of the Niro’s design has been carefully considered with the environment in mind.

Innovative Technology:

In addition to its efficient powertrain and sustainable materials, the Kia Niro also boasts a host of innovative technology features designed to further reduce its environmental impact. From regenerative braking that captures energy during deceleration to advanced aerodynamics that minimize drag, every aspect of the Niro’s design has been optimized for maximum efficiency.

Versatile Performance:

But being eco-friendly doesn’t mean sacrificing performance. The Kia Niro offers drivers a versatile driving experience that is both responsive and engaging. Whether navigating city streets or cruising down the highway, the Niro delivers smooth acceleration and confident handling, making every drive a pleasure.

Driving Green:

With its efficient design, sustainable materials, and innovative technology, the Kia Niro is leading the charge in eco-friendly driving. By choosing the Niro, drivers can feel good about their impact on the environment without compromising on style, performance, or comfort. It’s a win-win for drivers and the planet alike. Read more about kia niro

Exploring the Tesla Model X

Alright, folks, today we’re diving into the world of the Tesla Model X. This isn’t just any SUV—it’s a glimpse into the future of electric vehicles, packed with innovative features that redefine the driving experience.

Unveiling the Cutting-Edge Features

Let’s start with what sets the Tesla Model X apart: its groundbreaking features. From the iconic falcon-wing doors that open upwards for a dramatic entrance to the panoramic windshield that offers an unparalleled view of the world outside, every aspect of this SUV is designed to impress. Step inside, and you’re greeted by a minimalist yet futuristic interior, complete with a massive touchscreen display that controls everything from navigation to entertainment.

Performance that Surpasses Expectations

But the Tesla Model X isn’t just about looks—it’s also a powerhouse on the road. With its dual-motor all-wheel drive system, this SUV delivers lightning-fast acceleration that will leave you breathless. Whether you’re merging onto the highway or navigating city streets, the Model X handles with precision and agility, making every drive a thrill.

The Power of Electric Efficiency

Of course, one of the most impressive features of the Tesla Model X is its electric powertrain. Say goodbye to gas stations and hello to the convenience of charging at home or at one of Tesla’s Supercharger stations. With a range that rivals traditional gas-powered vehicles and the ability to go from 0 to 60 mph in a matter of seconds, the Model X proves that electric vehicles can be just as capable, if not more so, than their fossil-fuel counterparts.

Safety at the Forefront

Safety is always a top priority for Tesla, and the Model X is no exception. Equipped with a suite of advanced safety features, including Autopilot technology that assists with driving tasks, this SUV offers peace of mind on every journey. The Model X has earned top safety ratings, proving that you can have both performance and protection in one package.

Practicality Meets Luxury

Despite its high-tech features and impressive performance, the Tesla Model X is also surprisingly practical. With seating for up to seven passengers and ample cargo space, this SUV is perfect for families or those who need room for gear. Plus, the falcon-wing doors not only look cool but also make it easier to access the rear seats in tight parking spaces.

Innovation On the Road

Driving the Tesla Model X isn’t just a commute—it’s an experience. From the whisper-quiet electric motor to the smooth, responsive handling, every aspect of this SUV is designed to make driving enjoyable. Whether you’re taking a road trip or just running errands around town, the Model X offers a level of comfort and sophistication that is unmatched in the world of SUVs.

Conclusion: Tesla Model X – Innovation Unleashed

In conclusion, the Tesla Model X is more than just a vehicle—it’s a symbol of innovation and progress in the automotive industry. With its cutting-edge features, impressive performance, and commitment to sustainability, this SUV represents the future of driving. So, if you’re ready to experience the thrill of electric efficiency and the luxury of Tesla’s engineering, look no further than the Model X. It’s time to unleash innovation on the road. Read more about tesla model x

Boost Your Ride’s Lifespan with Essential Car Care Tactics

Maintaining your car isn’t just about keeping it clean; it’s about ensuring it runs smoothly and stands the test of time. Dive into these essential car care tactics to elevate your ride’s lifespan and keep those wheels turning.

Unveiling Proven Strategies for Effective Car Maintenance

Car maintenance might seem like a hassle, but with the right strategies, you can make it a breeze. Regularly check and change the oil, ensuring that your engine stays lubricated and performs optimally. This simple step can go a long way in preventing costly repairs and extending your car’s life.

Navigate the Roads Safely: A Guide to Routine Vehicle Care

Your safety on the road starts with routine vehicle care. Regularly inspect your tires for proper inflation and tread depth. Under-inflated tires can reduce fuel efficiency and compromise safety. Rotate your tires regularly to ensure even wear, extending their lifespan and enhancing your car’s performance.

DIY Car TLC: Mastering the Art of General Maintenance

Don’t be intimidated by the prospect of maintaining your car. Embrace the DIY spirit and master the art of general maintenance. Check and replace your air filters to improve fuel efficiency and protect your engine. Basic tasks like changing wiper blades and inspecting lights can make a significant difference in your overall driving experience.

Keep Your Wheels Turning: Top Tips for Car Health

To keep your wheels turning, pay attention to your vehicle’s vital signs. Monitor the dashboard for warning lights and address issues promptly. Regularly inspect the brakes for wear and tear. Timely brake maintenance not only ensures safety but also prevents more extensive and expensive repairs down the road.

Road-Ready Rides: Fundamental Car Maintenance Techniques

Fundamental car maintenance techniques are the foundation for road-ready rides. Keep an eye on your car’s fluids, including coolant, brake fluid, and transmission fluid. Regularly top them off or replace them as needed. Proper fluid levels contribute to optimal performance and protect vital components.

Prolong Your Vehicle’s Prime: General Car Care Explained

Understanding general car care is key to prolonging your vehicle’s prime. Follow the manufacturer’s recommended maintenance schedule outlined in your owner’s manual. This includes regular inspections, fluid changes, and filter replacements. Adhering to these guidelines will keep your car running smoothly and extend its overall lifespan.

Rev Up Reliability: 30 Key Car Maintenance Hacks

Rev up the reliability of your car with these 30 key maintenance hacks. From using the right fuel to keeping your tires properly inflated, small habits can have a big impact. Invest in a quality battery charger to ensure your battery stays charged, especially during periods of inactivity. These hacks add up to a more reliable and efficient vehicle.

Drive Smart, Drive Safe: A Comprehensive Car Maintenance Manual

A comprehensive car maintenance manual is your guide to driving smart and safe. Regularly inspect and replace your vehicle’s belts and hoses, as they play a crucial role in engine function. Check your lights, signals, and brakes to enhance visibility and responsiveness, contributing to an overall safer driving experience.

Gear Up for Success: A Concise Guide to Car Wellness

Gear up for success by prioritizing your car’s wellness. Regularly check the alignment and balance of your tires to prevent uneven wear. Invest in quality windshield wipers and replace them as soon as they show signs of wear. Small investments in these areas can make a significant difference in your overall driving comfort and safety.

Mastering Car Maintenance: Your Road to Smooth Travels

Mastering car maintenance is your road to smooth travels. Pay attention to unusual sounds or vibrations, as they may indicate underlying issues. Addressing these early can prevent more extensive damage and costly repairs. Taking the time to understand your vehicle’s nuances will make your driving experience more enjoyable and stress-free.

Road-Worthy Routines: Maximize Your Car’s Longevity

Maximizing your car’s longevity involves adopting road-worthy routines. Regularly clean and wax your vehicle to protect the paint and prevent rust. Address minor cosmetic issues promptly to prevent them from escalating. These simple routines contribute to a vehicle that not only runs well but looks good on the road.

Essential Tips for Every Car Owner’s Maintenance Arsenal

Every car owner needs a robust maintenance arsenal. Keep your engine cool by regularly checking and topping off coolant levels. Inspect and replace your spark plugs to ensure efficient combustion. These essential tips should be part of every car owner’s toolkit to maintain optimal performance.

DIY Auto Bliss: Unlocking the Secrets of Car Upkeep

Unlock the secrets of car upkeep with a DIY mindset. Learn to change your air and cabin filters to ensure clean air circulation in the vehicle. Regularly inspect your suspension components for signs of wear, as a smooth ride contributes to overall driving pleasure. Embracing the DIY approach not only saves money

Mastering Car Detailing: Standard Tips for a Gleaming Finish

So, you’re ready to transform your ride from mundane to magnificent through the magic of car detailing. Buckle up as we unveil the standard tips that will have your vehicle gleaming like it just rolled off the showroom floor.

Essential Tools of the Trade

Before you dive into the world of car detailing, ensure you’ve got the essential tools. Quality microfiber cloths, a range of brushes for various surfaces, a gentle car wash soap, and a reputable wax or sealant are must-haves. Don’t forget a bucket, hose, and a shade to protect your paint from the unforgiving sun.

Start with a Thorough Wash

The foundation of every successful car detailing venture is a thorough wash. Use a two-bucket method to minimize swirls – one for soapy water and another for rinsing. Start at the top and work your way down, ensuring every nook and cranny gets the attention it deserves. Pro tip: Invest in a grit guard for your rinse bucket to trap dirt and prevent it from getting back onto your sponge.

Tire and Wheel Magic

Your tires and wheels are the unsung heroes of your ride. Give them the attention they deserve. Use a quality wheel cleaner and a tire brush to remove brake dust and grime. Don’t forget to apply a tire dressing for that extra pop. Gleaming wheels not only enhance the overall look but also protect against corrosion.

Clay Bar Magic

Once your car is clean, take it a step further with a clay bar treatment. This nifty tool removes contaminants embedded in your paint, leaving it smooth as silk. Apply a lubricant, glide the clay bar over the surface, and feel the difference. Your paint will thank you with a deep, lustrous shine.

Polishing for Perfection

Now that your car is clean and smooth, it’s time to tackle imperfections. Polishing removes swirl marks, light scratches, and oxidation. Choose a quality polish and apply it using a polishing pad and a machine if you have one. Work in small sections and revel in the transformation as your paint comes to life.

Wax On, Wax Off

Protect that newly polished surface with a generous coat of wax. Whether you prefer traditional paste wax, liquid wax, or a synthetic sealant, the key is to apply it evenly and let it cure. The result? A protective layer that enhances shine and shields your paint from the elements.

Interior Elegance

Don’t neglect the interior – it’s where you spend your time, after all. Vacuum thoroughly, use a soft brush to remove dust from crevices, and wipe down surfaces with a suitable cleaner. Condition leather seats to keep them supple, and don’t forget the glass – streak-free windows elevate the overall interior aesthetic.

Attention to Detail: Trim and Glass

Details matter, and that includes your trim and glass. Use a trim restorer to revive faded plastic and rubber. For the glass, choose a quality glass cleaner and a microfiber towel for streak-free clarity. A little extra attention to these often overlooked areas can make a significant difference.

Consistency is Key

Car detailing isn’t a one-and-done deal. To maintain that pristine finish, make it a regular habit. Regular washing, occasional clay bar treatments, and consistent waxing will keep your ride looking showroom-worthy. Don’t forget to address any spots or imperfections promptly to prevent long-term damage.

Professional Touch: When in Doubt

If you’re not up for the DIY route or your car needs some extra love, consider professional detailing. Detailing experts have the knowledge, tools, and products to take your vehicle’s appearance to the next level. A professional touch can revive even the dullest paint and leave your car looking better than ever.

In the Driver’s Seat

And there you have it – the standard tips for mastering car detailing. Whether you’re a weekend warrior or a detailing enthusiast, these tips will have your ride turning heads wherever you go. So, grab your gear, channel your inner detailer, and enjoy the satisfaction of cruising in a gleaming masterpiece. Read more about standard tip for car detailing

Personalized Attention: Exploring Car Service Packages

In the realm of automotive care, one size does not fit all. That’s where car service packages come into play, offering a tailored approach to vehicle maintenance and repair that meets the unique needs of every driver.

A Comprehensive Approach to Care

Car service packages encompass a range of services designed to keep your vehicle running smoothly and efficiently. From routine oil changes and tire rotations to more complex repairs and diagnostics, these packages offer a comprehensive solution to all your automotive needs.

Convenience at Your Fingertips

One of the key benefits of car service packages is convenience. Rather than scheduling individual appointments for each maintenance task, these packages streamline the process by bundling multiple services into one convenient package. This not only saves you time but also ensures that your vehicle receives the attention it needs to stay in top condition.

Cost-Effective Solutions

Car service packages also offer cost-effective solutions for vehicle maintenance. By bundling services together, providers are able to offer discounted rates compared to individual service appointments. This not only helps you save money in the long run but also allows you to budget for your vehicle’s maintenance more effectively.

Tailored to Your Needs

Every driver has unique needs when it comes to vehicle maintenance, and car service packages recognize that fact. Whether you’re a commuter racking up miles on the highway or a weekend warrior hitting the trails, there’s a package that’s tailored to your specific driving habits and preferences.

Embracing Preventive Maintenance

Preventive maintenance is the cornerstone of any effective car service package. By addressing potential issues before they become major problems, these packages help you avoid costly repairs down the road. From inspecting belts and hoses to checking fluid levels and filters, preventive maintenance keeps your vehicle running smoothly and reliably.

Transparency and Trust

When it comes to vehicle maintenance, transparency and trust are essential. Car service packages offer peace of mind by providing clear pricing and detailed descriptions of the services included. This transparency helps build trust between drivers and service providers, ensuring that you always know exactly what you’re getting for your money.

Expertise You Can Depend On

Car service packages are administered by trained professionals who understand the ins and outs of automotive care. Whether it’s performing a routine inspection or diagnosing a complex issue, these experts have the knowledge and experience to keep your vehicle running at its best.

The Future of Automotive Care

As technology continues to advance, car service packages are evolving to meet the changing needs of drivers. From incorporating diagnostic tools and software updates to offering eco-friendly options for vehicle maintenance, these packages are at the forefront of innovation in the automotive industry.

Experience the convenience and reliability of Car Service Packages and keep your vehicle in top condition with ease.

Effortless Mobility: Navigating with Alamo Car Rental

A Seamless Rental Experience

Alamo Car Rental offers travelers a seamless rental experience, making it easy to hit the road and explore new destinations with confidence. With their user-friendly website and mobile app, booking a rental car with Alamo is a breeze. Whether you’re planning a spontaneous weekend getaway or a long-awaited vacation, Alamo’s hassle-free booking process ensures that you can secure your rental vehicle in no time.

Diverse Vehicle Selection

Alamo boasts a diverse selection of vehicles to suit every traveler’s needs and preferences. From compact cars for solo adventurers to spacious SUVs for family road trips, Alamo has a vehicle for every occasion. With well-maintained and reliable vehicles, you can trust that your rental car will get you where you need to go safely and comfortably.

Exceptional Customer Service

At Alamo, customer satisfaction is a top priority. Their dedicated team of professionals is committed to providing exceptional service and support to ensure that your rental experience exceeds your expectations. Whether you have questions about your reservation or need assistance during your trip, Alamo’s friendly and knowledgeable staff is always available to help.

Convenient Pickup and Drop-off Locations

With convenient pickup and drop-off locations at airports, hotels, and popular destinations worldwide, Alamo makes it easy to access your rental car wherever your travels take you. Whether you’re arriving at your destination by plane, train, or bus, you can rely on Alamo to provide reliable transportation to get you on your way quickly and conveniently.

Safety and Cleanliness

In response to the COVID-19 pandemic, Alamo has implemented enhanced cleaning and safety protocols to ensure the health and well-being of their customers and employees. With rigorous sanitation measures in place, you can rest assured that your rental car will be thoroughly cleaned and sanitized before each use. Additionally, Alamo offers contactless pickup and drop-off options to minimize contact and promote safety.

Global Presence

With locations in over 50 countries worldwide, Alamo provides travelers with global accessibility and convenience. Whether you’re traveling domestically or abroad, you can rely on Alamo to provide reliable transportation wherever your adventures take you. Plus, with multilingual support and local expertise, navigating new destinations is a breeze with Alamo by your side.

Innovative Technology

Alamo is committed to leveraging innovative technology to enhance the rental experience for their customers. From digital check-in and keyless entry to GPS navigation systems and in-car Wi-Fi, Alamo’s cutting-edge technology ensures that you have everything you need for a smooth and enjoyable journey.

Environmental Responsibility

As a responsible corporate citizen, Alamo is committed to environmental sustainability. Through initiatives such as their Green Traveler Collection, which features fuel-efficient and eco-friendly vehicles, Alamo is working to reduce their carbon footprint and promote sustainable travel practices.

Embrace Effortless Mobility with Alamo

In conclusion, Alamo Car Rental offers travelers a convenient and reliable way to explore new destinations with ease. With their seamless booking process, diverse vehicle selection, exceptional customer service, and commitment to safety and sustainability, Alamo is the perfect choice for your next adventure. So why wait? Embrace effortless mobility with Alamo and start your journey today.

Embark on Sustainable Adventures with Green Car Rentals

Driving Toward a Greener Future

In an era where environmental consciousness is paramount, green car rentals emerge as a beacon of sustainable travel. These eco-friendly vehicles not only offer a means of transportation but also embody a commitment to reducing carbon footprints and preserving the planet for future generations.

Efficiency and Environmental Impact

Green car rentals are synonymous with efficiency and reduced environmental impact. With advanced technology and innovative engineering, these vehicles harness clean energy sources such as electricity or hybrid systems to minimize emissions and maximize fuel efficiency. By choosing green car rentals, travelers can make a positive contribution to environmental conservation without sacrificing convenience or comfort.

A Clean and Serene Driving Experience

One of the hallmark features of green car rentals is their quiet and serene driving experience. Electric motors power these vehicles with minimal noise, creating a peaceful atmosphere for passengers to enjoy the journey. Free from the rumble of traditional combustion engines, travelers can immerse themselves in the sights and sounds of nature, fostering a deeper connection with the environment.

Versatility and Adaptability

Despite their eco-friendly credentials, green car rentals offer versatility and adaptability to various travel needs. Whether navigating bustling city streets or embarking on cross-country road trips, these vehicles deliver reliable performance and seamless driving experiences. From compact electric cars to spacious hybrid SUVs, green car rentals cater to diverse preferences and travel requirements.

Green Car Rentals: Your Sustainable Solution

Ready to embark on a sustainable journey? Look no further than Green car rentals from OffRoadTaxi.net. With a diverse fleet of eco-friendly vehicles to choose from, including electric cars, hybrid models, and fuel-efficient options, travelers can find the perfect rental to align with their environmental values. Plus, with transparent pricing and flexible rental options, OffRoadTaxi.net ensures a seamless and hassle-free booking experience.

Booking Made Easy

Booking a green car rental with OffRoadTaxi.net is straightforward and convenient. Simply visit our website, browse our selection of eco-friendly vehicles, and book your rental with ease. With user-friendly booking interfaces, secure payment options, and responsive customer support, OffRoadTaxi.net prioritizes customer satisfaction and peace of mind throughout the rental process.

Fueling Sustainable Travel

With green car rentals from OffRoadTaxi.net, travelers can enjoy guilt-free exploration and eco-friendly adventures. Whether navigating urban landscapes or traversing natural wonders, our eco-friendly rentals provide a sustainable and responsible mode of transportation. Join us in driving toward a greener future and start planning your next environmentally conscious journey with OffRoadTaxi.net today.

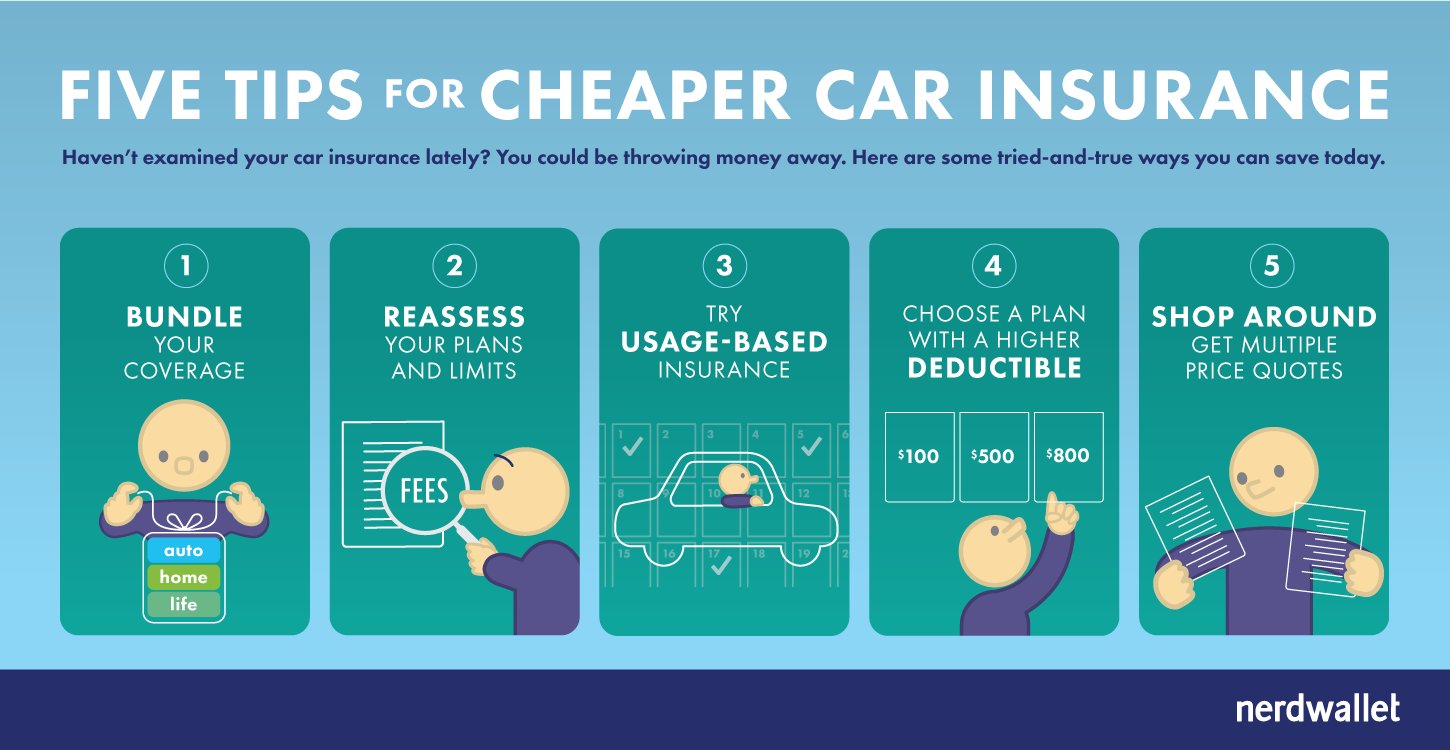

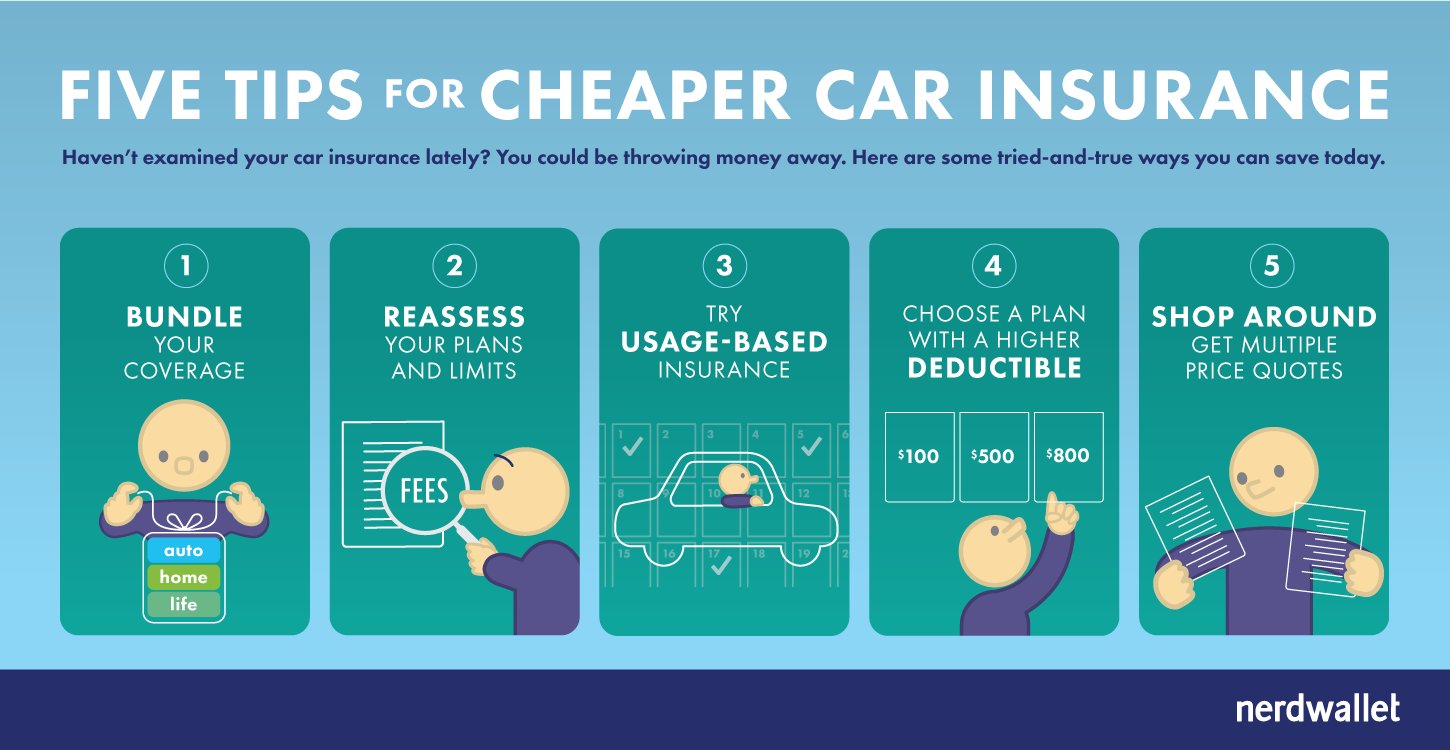

Understanding Usage-Based Car Insurance

Usage-based car insurance, also known as telematics insurance, is revolutionizing the way drivers think about coverage. By utilizing advanced technology to monitor driving behavior, this innovative approach offers a personalized alternative to traditional insurance models.

How Does it Work?

At the heart of usage-based car insurance is the concept of tracking driving habits in real-time. Telematics devices, often installed in the vehicle or accessed through mobile apps, collect data on various aspects of driving, including speed, mileage, acceleration, braking, and even the time of day when the vehicle is in use. This data is then used by insurance companies to assess risk and determine premiums.

Benefits for Drivers

One of the primary benefits of usage-based car insurance is its potential to save drivers money. By basing premiums on actual driving behavior rather than statistical averages or demographic factors, drivers who demonstrate safe and responsible habits can enjoy lower rates. This can be particularly advantageous for individuals who have low mileage, drive during off-peak hours, or maintain consistent driving patterns.

Customized Pricing

Usage-based car insurance offers a level of customization that traditional insurance plans simply cannot match. Rather than being locked into a fixed premium based on factors like age, gender, or location, drivers have the opportunity to influence their insurance costs directly through their driving habits. This transparency and control empower drivers to take an active role in managing their insurance expenses.

Incentives for Safe Driving

In addition to potential cost savings, usage-based car insurance often includes incentives and rewards for safe driving behavior. Many insurance companies offer discounts, bonuses, or cashback rewards to drivers who consistently demonstrate safe habits on the road. This not only benefits individual drivers but also contributes to overall road safety by encouraging responsible behavior behind the wheel.

The Role of Offroadtaxi.net

For drivers interested in exploring usage-based car insurance options, Offroadtaxi.net provides a valuable resource. Their platform connects drivers with insurance providers that offer telematics-based insurance plans tailored to their needs. By leveraging their expertise and network of partners, Offroadtaxi.net simplifies the process of finding and comparing usage-based insurance policies.

Enhanced Safety Features

Another advantage of usage-based car insurance is its potential to promote safer driving habits. By providing drivers with real-time feedback on their driving performance, telematics devices encourage greater awareness and accountability on the road. Over time, this can lead to improvements in driving behavior and a reduction in accidents and claims.

Privacy Considerations

While the benefits of usage-based car insurance are clear, some drivers may have concerns about privacy and data security. It’s important for drivers to understand how their data will be collected, used, and protected by insurance companies. Transparency and clear communication about data practices are essential to building trust and ensuring that drivers feel comfortable participating in telematics programs.

The Future of Car Insurance

As technology continues to evolve, usage-based car insurance is poised to become increasingly prevalent in the insurance industry. With its ability to offer personalized pricing, incentives for safe driving, and enhanced safety features, this innovative approach represents a significant shift from traditional insurance models. By embracing telematics-based solutions, drivers can enjoy greater control over their insurance costs and contribute to a safer, more sustainable future on the road.

Unlocking the Potential of Expert Car Tips for a Smoother Ride

Driving is more than just a means of transportation; it’s an experience. To make the most of your time on the road, incorporating expert car tips can significantly enhance your driving experience. From maintenance insights to efficiency hacks, these tips cover various aspects of car ownership, ensuring a smoother and more enjoyable ride.

Understanding the Importance of Regular Maintenance

Regular maintenance is the cornerstone of a well-functioning vehicle. Expert car tips often emphasize the significance of routine check-ups, oil changes, and tire rotations. These seemingly small tasks contribute to the overall longevity and performance of your car. By staying proactive in maintenance, you can avoid costly repairs and ensure that your vehicle operates at its best.

Efficiency Hacks for Fuel Economy

As fuel prices fluctuate, finding ways to improve fuel economy is a priority for many drivers. Expert car tips include practical suggestions such as maintaining optimal tire pressure, reducing unnecessary weight in your vehicle, and adhering to a consistent maintenance schedule. These simple adjustments can lead to significant savings over time, benefiting both your wallet and the environment.

Navigating Challenging Driving Conditions

Expert car tips extend beyond the routine, offering insights on handling challenging driving conditions. Whether it’s driving in heavy rain, snow, or navigating through city traffic, expert advice can make a difference. From adjusting your driving speed to keeping a safe following distance, these tips enhance safety and confidence on the road.

Optimizing Vehicle Technology

Modern vehicles come equipped with a plethora of advanced technologies designed to improve safety and convenience. Expert car tips guide you on optimizing these features, from utilizing adaptive cruise control to understanding the nuances of lane-keeping assist. Staying informed about your vehicle’s technology ensures that you harness its full potential for a safer and more enjoyable drive.

DIY Repairs and Troubleshooting

Empowering yourself with basic DIY repair skills can save you time and money. Expert car tips often include step-by-step guides for common issues such as changing a flat tire, replacing brake pads, or troubleshooting minor engine problems. Having this knowledge can be invaluable, especially in situations where immediate professional assistance may not be available.

Investing in Quality Accessories

Enhancing your driving experience goes beyond the mechanics of your vehicle. Expert car tips often highlight the value of investing in quality accessories. From comfortable seat cushions to advanced entertainment systems, these additions can make your time on the road more enjoyable and personalized.

Choosing the Right Insurance Coverage

Car insurance is a non-negotiable aspect of vehicle ownership. Expert car tips guide you in choosing the right insurance coverage tailored to your needs. Understanding the nuances of coverage options, deductibles, and policy terms ensures that you are adequately protected in the event of an unforeseen incident.

Expert Car Tips for a Safer Nighttime Driving Experience

Driving at night poses unique challenges, from reduced visibility to potential fatigue. Expert car tips for nighttime driving include recommendations on adjusting your headlights, minimizing distractions, and recognizing the signs of driver fatigue. Implementing these tips can significantly improve safety during nocturnal journeys.

The Convenience of Expert Car Tips at OffRoadTaxi.net

For a comprehensive resource on expert car tips, visit OffRoadTaxi.net. This platform offers a wealth of information to elevate your driving experience. From maintenance guides to technology insights, OffRoadTaxi.net serves as your go-to source for expert advice, ensuring that you drive with confidence and expertise.

Exploring Car Rebates and Incentives

Car rebates and incentives offer a valuable opportunity for savvy buyers to save money on their vehicle purchase. Let’s dive into the world of car rebates and incentives, understanding how they work and how they can benefit you.

Understanding Car Rebates

Car rebates are incentives offered by manufacturers to encourage sales of specific models. These rebates typically come in the form of cash discounts or rebates applied directly to the purchase price of the vehicle. By taking advantage of rebates, buyers can enjoy instant savings on their car purchase.

Types of Rebates

There are several types of car rebates available to buyers, including cash rebates, low-interest financing offers, and lease incentives. Cash rebates provide a direct discount on the purchase price of the vehicle, while low-interest financing offers allow buyers to finance their purchase at a reduced interest rate. Lease incentives may include discounted monthly payments or waived lease initiation fees.

Qualifying for Rebates

Qualifying for car rebates typically depends on factors such as the make and model of the vehicle, the buyer’s location, and any special promotions offered by the manufacturer or dealership. Buyers may need to meet certain eligibility criteria, such as financing through the manufacturer’s preferred lender or trading in a qualifying vehicle.

Timing Your Purchase

Timing can play a significant role in maximizing your savings with car rebates. Manufacturers often introduce new rebates and incentives at specific times of the year, such as during end-of-year clearance events or new model launches. By timing your purchase strategically, you can take advantage of the most lucrative rebate offers available.

Researching Available Offers

Before heading to the dealership, it’s essential to research the available car rebates and incentives for the make and model you’re interested in. Manufacturer websites, dealership advertisements, and automotive forums are valuable resources for finding information about current rebate offers and promotions.

Negotiating with Dealerships

When negotiating the purchase of your car, don’t forget to factor in any available rebates and incentives. Dealerships may be willing to apply these savings to your purchase price or offer additional discounts to sweeten the deal. Be prepared to negotiate and advocate for the best possible price, taking advantage of any rebates available to you.

Reading the Fine Print

Before finalizing your purchase, be sure to read the fine print of any rebate offers carefully. Pay attention to details such as expiration dates, eligibility requirements, and any restrictions or limitations that may apply. Understanding the terms of the rebate ensures you receive the full benefit of the offer.

Considering Long-Term Savings

While car rebates offer immediate savings on your purchase, it’s essential to consider the long-term financial implications as well. By reducing the purchase price of your vehicle or securing favorable financing terms, rebates can help lower your monthly payments and save you money over the life of your loan or lease.

Exploring Additional Incentives

In addition to manufacturer rebates, buyers may also qualify for additional incentives from government agencies, employers, or membership organizations. These incentives can further reduce the cost of car ownership, making it more affordable to purchase and maintain a vehicle.

Making an Informed Decision

Ultimately, taking advantage of car rebates and incentives requires careful consideration and research. By understanding how rebates work, timing your purchase strategically, and negotiating effectively with dealerships, you can maximize your savings and enjoy a great deal on your next car purchase.

Car rebates and incentives provide an excellent opportunity for buyers to save money and get the most value out of their vehicle purchase. By understanding the types of rebates available, qualifying criteria, and how to leverage them during negotiations, buyers can make informed decisions and drive away with a great deal on their new car.

Certainly! Here’s the article:

Exploring the World of No Credit Check Car Rentals

Understanding the Concept

No credit check car rentals offer a convenient option for individuals who may have limited or poor credit history. Unlike traditional car rental companies that require a credit check as part of the rental process, these providers allow renters to secure a rental vehicle without undergoing a credit check.

Accessible Option

For individuals who have experienced financial difficulties or who have a limited credit history, traditional car rental companies may pose challenges due to their credit check requirements. No credit check car rentals provide an accessible alternative, allowing renters to bypass the credit check process and secure a rental vehicle based on other criteria, such as proof of income or a valid driver’s license.

Rental Process

The rental process for no credit check car rentals is typically straightforward and streamlined. Renters are required to provide basic information, such as their name, address, and contact details, as well as proof of identity and insurance. Some rental companies may also require proof of income or a security deposit to secure the rental.

Documentation Requirements

While no credit check car rentals do not require a credit check, renters must still meet certain documentation requirements to qualify for a rental. This may include providing a valid driver’s license, proof of insurance, and proof of identity. Renters should review the documentation requirements of their chosen rental company before booking a rental to ensure they have everything they need to complete the rental process.

Alternative Criteria

In lieu of a credit check, no credit check car rental companies may use alternative criteria to assess a renter’s eligibility for a rental. This may include reviewing a renter’s driving history, employment status, or rental history. By considering these alternative criteria, renters with limited or poor credit history can still qualify for a rental vehicle and enjoy the benefits of car rental services.

Cost Considerations

While no credit check car rentals offer accessibility and convenience, renters should be aware that they may come with additional costs compared to traditional car rentals. Rental companies may charge higher rental rates, security deposits, or fees to offset the perceived risk of renting to individuals without a credit check. Renters should carefully review the rental terms and conditions and consider any additional costs before booking a rental.

Insurance Options

No credit check car rental companies typically offer insurance options to protect renters and the rental vehicle in the event of accidents, theft, or damage. Renters should carefully review the insurance options provided by their chosen rental company and consider their individual needs before opting for coverage. Additionally, renters may also have the option to use their own insurance coverage or purchase supplemental insurance from a third-party provider.

Customer Experience

Renters who choose no credit check car rentals can expect a customer-centric experience focused on accessibility and convenience. Rental companies may offer flexible rental terms, convenient pickup and drop-off locations, and responsive customer support to ensure a positive rental experience for all renters. By prioritizing customer satisfaction, rental companies aim to provide a seamless and hassle-free rental experience for renters of all backgrounds.

Planning Ahead

Before booking a no credit check car rental, renters should take the time to research their options and familiarize themselves with the rental terms and conditions. This includes reviewing documentation requirements, understanding alternative criteria for qualification, and considering any additional costs associated with the rental. By planning ahead and being informed, renters can enjoy a smooth and stress-free rental experience with no credit check car rentals.

Embracing Accessibility

No credit check car rentals offer an accessible option for individuals who may have limited or poor credit history. By providing an alternative to traditional car rental companies’ credit check requirements, these providers enable renters to secure a rental vehicle based on other criteria and enjoy the convenience of car rental services without the barriers imposed by credit checks.

USA Oil Change Tips: Ensuring Engine Health and Performance

Rusty January 26, 2024 Article

Ensuring Engine Health: Unveiling USA Oil Change Tips

Maintaining your vehicle’s engine health is a fundamental aspect of responsible car ownership. USA Oil Change Tips offer valuable insights and practices to ensure optimal engine performance, longevity, and fuel efficiency. In this article, we explore the significance of regular oil changes and the tips provided by experts in the USA.

The Role of Oil in Engine Functionality

Oil serves as the lifeblood of your vehicle’s engine, providing lubrication to various moving parts. Over time, oil can become contaminated with debris and lose its viscosity, compromising its ability to protect the engine. Regular oil changes are essential to keep the engine running smoothly and prevent premature wear and tear.

Frequency of Oil Changes: Expert Recommendations

One of the primary USA Oil Change Tips emphasizes the importance of adhering to a regular oil change schedule. The frequency may vary based on factors such as the type of oil used, driving conditions, and the vehicle’s age. Experts commonly recommend changing the oil every 3,000 to 5,000 miles, but consulting your vehicle’s manual and considering your driving habits is crucial for a personalized schedule.

Choosing the Right Oil: Tailoring to Your Engine’s Needs

The USA Oil Change Tips highlight the significance of selecting the right oil for your engine. Different engines may require different types of oil, such as conventional, synthetic, or a blend. Understanding your vehicle’s specifications and the conditions in which you drive allows you to make an informed choice that contributes to optimal engine performance.

Oil Filter Replacement: A Crucial Companion to Oil Changes

In conjunction with oil changes, replacing the oil filter is equally vital. The filter plays a key role in trapping contaminants and preventing them from circulating in the engine. USA Oil Change Tips stress the importance of replacing the oil filter during every oil change to maintain the overall health of the engine.

DIY Oil Changes: Tips for the At-Home Enthusiast

For those inclined toward DIY car maintenance, USA Oil Change Tips offer guidance on executing oil changes at home. This includes steps such as safely lifting the vehicle, draining the old oil, and properly disposing of used oil. Following these tips ensures a seamless at-home oil change while saving on maintenance costs.

Signs of Engine Trouble: Recognizing the Need for an Oil Change

USA Oil Change Tips educate drivers on recognizing signs that indicate the need for an immediate oil change. Symptoms like engine knocking, dark or gritty oil on the dipstick, and a burning smell may signal that the oil has exceeded its useful life. Being vigilant about these signs helps address potential issues before they escalate.

Professional Oil Change Services: Ensuring Precision and Expertise

While DIY oil changes can be rewarding, USA Oil Change Tips acknowledge the expertise provided by professional services. Professional technicians are equipped with the knowledge and tools to perform thorough oil changes, including proper disposal of used oil. Seeking professional services ensures precision and adherence to manufacturer recommendations.

Environmental Responsibility: Proper Oil Disposal

USA Oil Change Tips extend beyond the technical aspects to address environmental responsibility. Proper disposal of used oil is crucial to prevent environmental harm. Recycling used oil at designated collection centers is an eco-friendly practice emphasized by these tips, contributing to sustainable and responsible car maintenance.

USA Oil Change Tips at OffRoadTaxi.net: A Comprehensive Resource

For a comprehensive guide to USA Oil Change Tips and more, visit OffRoadTaxi.net. This platform serves as a valuable resource, offering in-depth insights into oil change practices, maintenance schedules, and expert recommendations. Explore OffRoadTaxi.net to empower yourself with the knowledge needed to ensure your vehicle’s engine health and longevity.

Subheading: The Value of Low-Cost Insurance Plans

Low-cost insurance plans provide a gateway to essential coverage at affordable rates, catering to individuals and families seeking adequate protection without straining their budgets. Understanding the advantages and considerations of these plans is crucial for making informed insurance decisions.

Affordability and Coverage: Balancing Financial Constraints

Low-cost insurance plans strike a balance between affordability and coverage. They offer essential protection against unforeseen circumstances while ensuring that monthly premiums fit within tighter financial constraints.

Basic Coverage Components: Essential Protection

Despite being cost-effective, these plans often include essential coverage components. They may encompass basic features such as liability coverage, property protection, and medical expenses, offering fundamental protection without unnecessary frills.

Risk Assessment and Premiums: Tailored Pricing

Insurers assess risks to tailor premiums for low-cost plans. While maintaining coverage standards, insurers often consider individual risk profiles, enabling them to offer competitive rates suited to specific circumstances.

Coverage Limitations: Understanding Restrictions

Low-cost insurance plans may have limitations. They might include higher deductibles, lower coverage limits, or specific exclusions. Understanding these limitations is vital to ensure coverage aligns with individual needs.

Customizable Options: Tailoring Coverage Needs

Despite being cost-effective, some low-cost plans offer customizable options. Policyholders may have the flexibility to add riders or adjust coverage levels, tailoring the plan to their evolving needs.

Eligibility and Qualifications: Accessing Affordable Coverage

Eligibility criteria vary for low-cost plans. They might be available based on income levels, employment status, or specific qualifications, making them accessible to individuals meeting these criteria.

Comparative Analysis: Evaluating Options

Comparing low-cost insurance plans is essential. Reviewing multiple options allows individuals to assess coverage, premiums, deductibles, and limitations, ensuring that the chosen plan aligns with their requirements.

Long-Term Considerations: Balancing Cost and Future Needs

Low-cost plans require long-term consideration. While they offer immediate affordability, individuals should evaluate whether the coverage adequately addresses potential future needs and circumstances.

Consultation and Guidance: Professional Assistance

Seeking consultation ensures understanding and informed decisions. Consulting insurance professionals or using online resources provides clarity about low-cost plans, ensuring that individuals make informed choices.

Conclusion: Low-Cost Insurance Plans for Essential Coverage

Low-cost insurance plans bridge the gap between affordability and essential coverage. By understanding their components, limitations, and customization options, individuals can secure adequate protection within their budget constraints.

For those seeking low-cost insurance plans tailored to their needs, consider exploring options at Low-Cost Insurance Plans. This platform offers comprehensive yet affordable coverage, ensuring essential protection without financial strain.

Subheading: Understanding the Importance of Affordable Insurance Premiums

In today’s fast-paced world, securing insurance coverage is more than a safety net; it’s a necessity. However, finding the right coverage that doesn’t break the bank can be a challenge. Affordable insurance premiums provide a crucial balance between financial security and budget constraints, offering individuals and businesses the opportunity to protect themselves without compromising their financial stability.

The Role of Affordable Insurance Premiums

Affordable insurance premiums play a pivotal role in ensuring that individuals and businesses can access necessary coverage without overextending their finances. They serve as a gateway to various insurance policies, including health, auto, home, and business insurance, enabling a diverse range of people to safeguard their interests.

The Impact on Financial Planning

One of the key advantages of affordable insurance premiums is their positive impact on financial planning. By securing insurance at reasonable costs, individuals can better allocate their resources. This allows for a more comprehensive financial strategy, reducing the risk of unforeseen expenses and providing a safety cushion in times of need.

Navigating the Market for Affordable Premiums

With the burgeoning insurance market, navigating the myriad of options available can be overwhelming. However, taking the time to compare various policies and premiums ensures that individuals can find the most suitable coverage at a price that aligns with their budget.

Affordable Premiums: A Link to Security

Affordable insurance premiums serve as a link to security, offering a pathway for individuals and businesses to safeguard their assets and well-being. Whether it’s ensuring access to quality healthcare, protecting vehicles and properties, or securing businesses against unforeseen risks, these premiums are the foundation upon which a secure future is built.

The Need for Reliable Insurance Providers

While affordability is a crucial factor, the reliability of insurance providers cannot be overlooked. Partnering with reputable insurance companies ensures not only competitive premiums but also reliable coverage when it matters the most. Establishing trust with insurance providers is essential for a seamless claims process and dependable support.

Closing Thoughts

Affordable insurance premiums are more than just a cost-saving measure; they represent a pathway to security and peace of mind. By carefully considering options, understanding the coverage needed, and partnering with reliable providers, individuals and businesses can secure their futures without compromising their financial stability. It’s about striking the right balance between cost and coverage to ensure protection without undue financial strain.

For those seeking affordable insurance premiums tailored to their needs, consider exploring options at Affordable Insurance Premiums. This platform offers a range of insurance solutions designed to fit various budgets and requirements, helping individuals and businesses find the right coverage without compromising financial stability.

Categories

- Art & Entertaiment

- Auction Cars

- Auction Cars

- Auto

- Auto

- Auto Deal

- Auto Deal

- Auto Discount

- Auto Discount

- Auto Mobile

- Auto Mobile

- Auto24 De

- Auto24 De

- Automobile

- Automobile De Germany

- Automobile De Germany

- Automobile Deutschland

- Automobile Deutschland

- Automotive

- Bargain Cars

- Bargain Cars

- Business & Economic

- Business Product

- Business Service

- Car Auctions In Maryland

- Car Auctions In Maryland

- Car Auctions UK

- Car Auctions UK

- Car Book Value

- Car Book Value

- Car Specials

- Car Specials

- Cars

- Cheap

- Cheap Car Leasing

- Cheap Car Leasing

- Cheap Cars

- Cheap Cars

- Convertible

- Convertible

- Education & Science

- Fashion & Shopping

- Finance

- Food & Travel

- General Article

- Health

- Home

- Industry & Manufacture

- Inexpensive Cars

- Inexpensive Cars

- Law & Legal

- Military Auctions

- Military Auctions

- Mobile

- Mobile Auto

- Mobile Auto

- Parenting & Family

- Pet & Animal

- Real Estate & Construction

- Sport & Hobby

- Technology & SaaS

- Wholesale Cars

- Wholesale Cars

Recent Posts

- Eco-Drive Excellence New Electric Cars Redefining Mobility”

- Embrace the Future EV SUVs for Eco-Conscious Drivers

- Power and Sustainability Exploring Plug-In Hybrid Cars

- Unveiling Volvo C40 Recharge Pure Electric Luxury SUV

- Conflict Resolution in the Workplace (HR)

- The Iconic Toyota Prius Pioneering Hybrid Excellence

- Used Hybrid Cars Your Eco-Friendly Choice

- Wholesale Fashion Accessories Latest Trends

- Rewind The Hottest 90s Fashion Accessories

- Texas Financial Advice What You Need to Know

- Miss Peaches Ready for Her Forever Family

- The New Face of Portraits Fresh Perspectives

- EQS SUV Price Guide Unveiling Mercedes’ Latest Offering

- Volvo Electric Driving Towards a Sustainable Future

- Bitcoin’s Future What’s Next for Crypto King?

- Introducing Tucson Hybrid Eco-Friendly SUV Innovation

- Unlocking Research New Grants for Academic Publishing

- DIY Halloween Costumes Creative & Budget-Friendly

- Understanding Modern Real Estate Finances

- Quality Control Analyst Ensuring Product Excellence