Navigating the Realm of High-Risk Car Insurance

For drivers labeled as high-risk, obtaining car insurance can be a daunting task. Let’s delve into the intricacies of high-risk car insurance and understand how it provides coverage for those facing unique challenges on the road.

Understanding High-Risk Classification

High-risk car insurance is designed for drivers who are considered to pose a higher risk to insurance companies due to factors such as a history of accidents, traffic violations, or DUI convictions. These drivers may face challenges in obtaining affordable coverage through standard insurance providers.

Addressing Unique Risk Factors

Drivers labeled as high-risk may face higher insurance premiums due to their increased likelihood of filing claims or causing accidents. High-risk car insurance is tailored to address these unique risk factors, providing coverage that reflects the elevated level of risk associated with insuring these drivers.

Meeting State Requirements

Despite their high-risk classification, drivers still need to meet state-mandated insurance requirements to legally operate a vehicle. High-risk car insurance ensures that these drivers have the minimum required coverage in place, allowing them to comply with state laws and maintain their driving privileges.

Customizing Coverage Options

High-risk car insurance offers a range of coverage options to suit the needs of individual drivers. While high-risk drivers may face higher premiums, they still have the opportunity to customize their coverage to fit their budget and preferences. This may include options such as liability coverage, collision coverage, and comprehensive coverage.

Navigating Premium Costs

One of the challenges for high-risk drivers is navigating the cost of insurance premiums. High-risk car insurance may come with higher premiums compared to standard insurance policies, reflecting the increased level of risk associated with insuring these drivers. However, there are still opportunities to find affordable coverage through comparison shopping and exploring discounts.

Understanding Coverage Limits

When purchasing high-risk car insurance, it’s essential to understand your coverage limits. These limits represent the maximum amount your insurance company will pay for damages resulting from an accident. It’s crucial to choose coverage limits that provide adequate protection without exceeding your budget.

Seeking Specialized Providers

For high-risk drivers, finding insurance coverage can be challenging through traditional insurance providers. However, there are specialized insurance companies that cater specifically to high-risk drivers. These providers understand the unique needs of high-risk drivers and offer tailored coverage options to meet their requirements.

Improving Driving Habits

While high-risk car insurance may provide coverage for drivers facing challenges on the road, it’s essential to work towards improving driving habits and reducing risk factors over time. By maintaining a clean driving record and avoiding further traffic violations, high-risk drivers can eventually qualify for standard insurance rates.

Exploring Options for High-Risk Coverage

In conclusion, high-risk car insurance offers coverage for drivers facing unique challenges on the road. Visit OffRoadTaxi.net to learn more about high-risk car insurance and explore your options for obtaining coverage as a high-risk driver. With the right understanding and guidance, high-risk drivers can navigate the insurance market and find the coverage that meets their needs.

Certainly! Here’s the article:

Understanding the Essentials of Renting a Car

Navigating the Booking Process

When it comes to renting a car, there are several requirements and considerations to keep in mind. From selecting the right vehicle to understanding insurance options, the process can seem daunting. However, with a bit of knowledge and preparation, you can navigate the booking process with ease.

Choosing the Right Vehicle

One of the first decisions you’ll face when renting a car is choosing the right vehicle for your needs. Whether you’re planning a road trip or simply need a reliable mode of transportation for getting around town, selecting the appropriate size and type of vehicle is essential. Consider factors such as the number of passengers, the amount of luggage you’ll be carrying, and any specific features you require, such as GPS navigation or child seats.

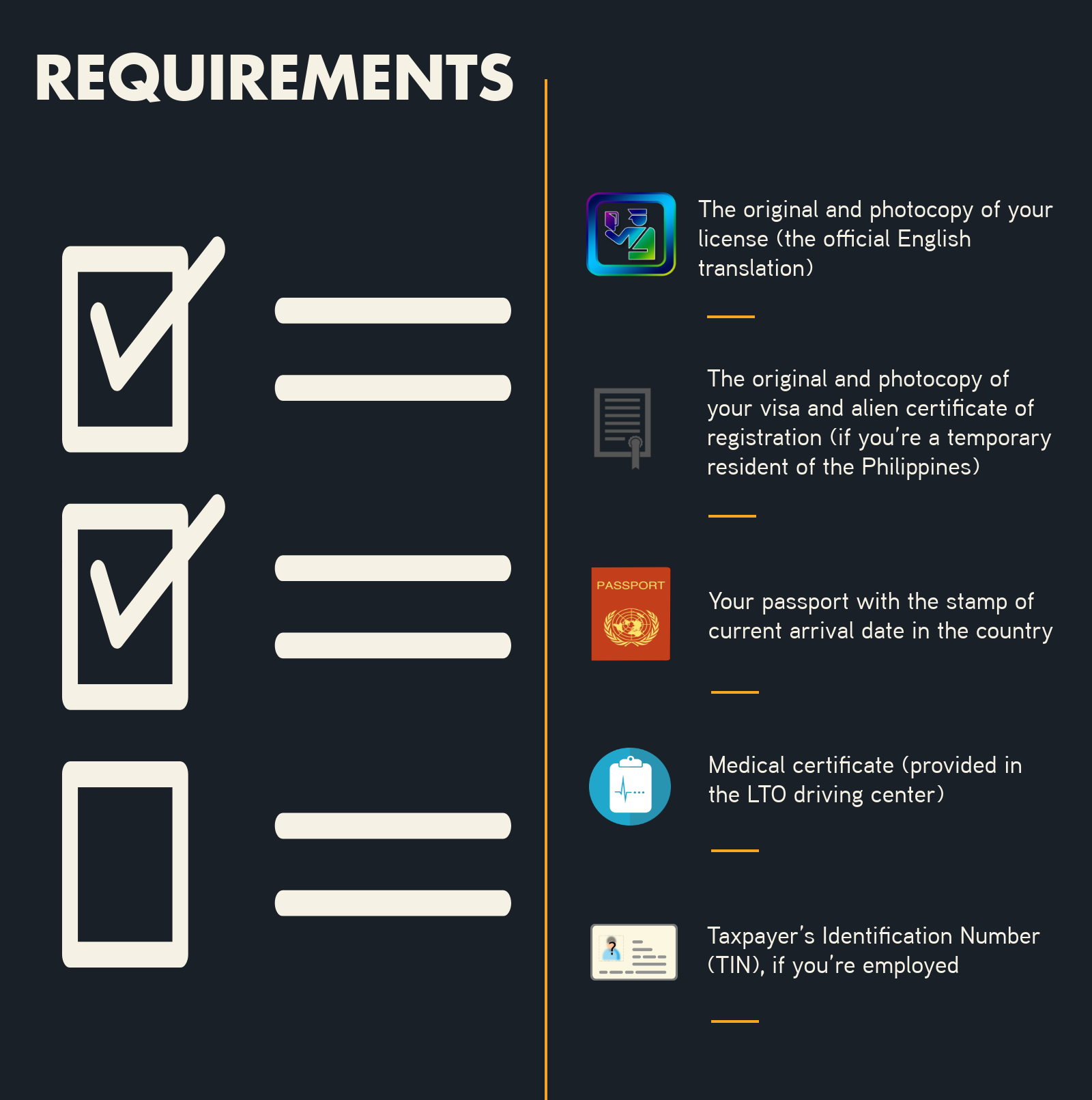

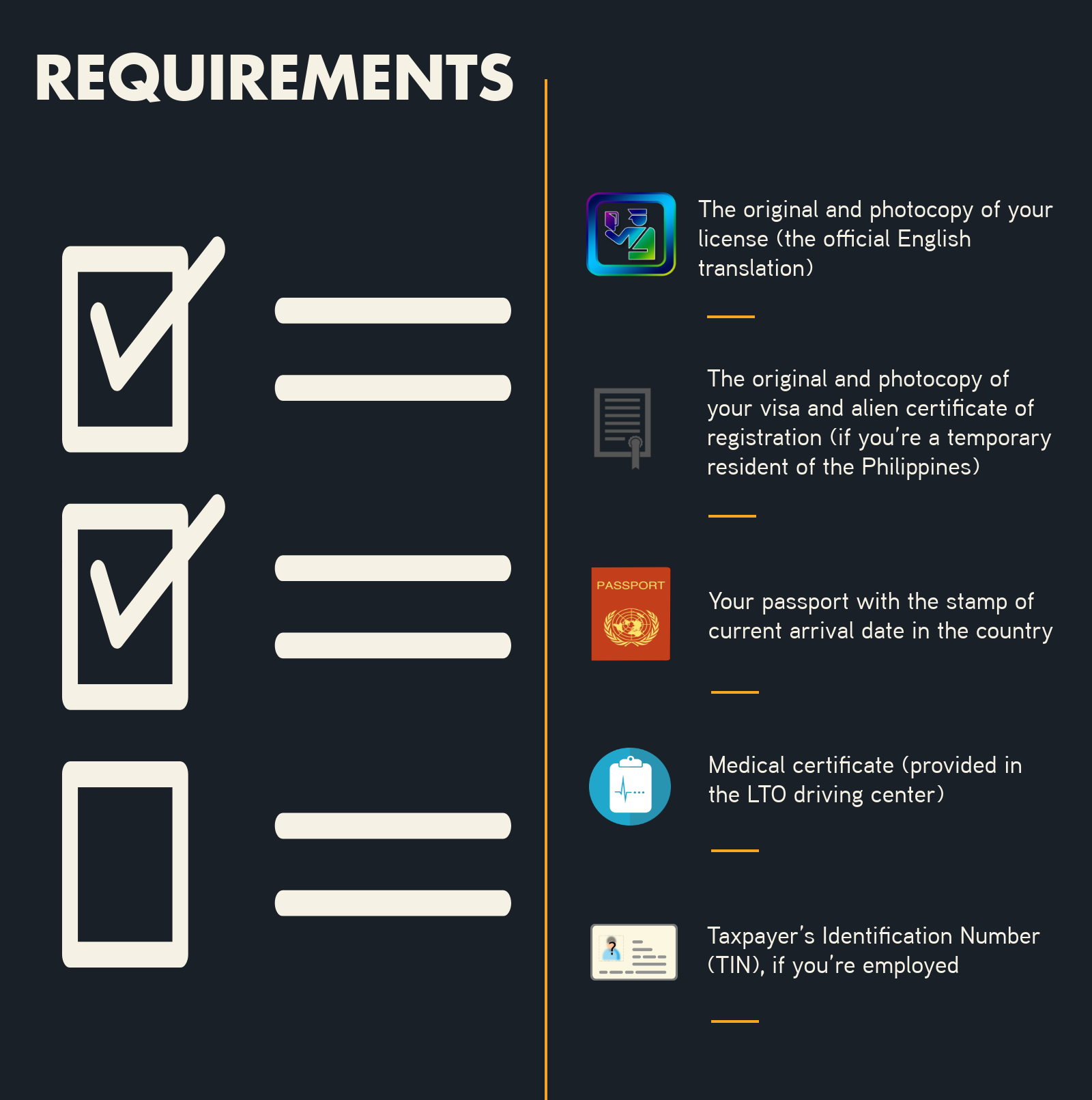

Understanding Rental Requirements

Before you can hit the road, you’ll need to meet certain rental requirements. These may include age restrictions, a valid driver’s license, and a major credit card for payment and security deposit purposes. Additionally, some rental companies may have specific policies regarding additional drivers, fueling options, and mileage limits. It’s essential to familiarize yourself with these requirements before making a reservation to ensure a smooth rental experience.

Navigating Insurance Options

One aspect of car rental requirements that often causes confusion is insurance. While rental companies typically offer insurance options at the time of booking, you may already have coverage through your personal auto insurance policy or credit card benefits. It’s essential to understand the extent of coverage provided by each option and determine whether additional insurance is necessary for your peace of mind. Consider factors such as deductibles, coverage limits, and exclusions when making your decision.

Reviewing Rental Agreements

Before signing on the dotted line, it’s crucial to carefully review the rental agreement. This document outlines the terms and conditions of your rental, including pricing, cancellation policies, and any additional fees or charges. Pay close attention to the fine print, and don’t hesitate to ask questions if anything is unclear. By understanding the terms of your rental agreement upfront, you can avoid surprises and ensure a transparent rental experience.

Inspecting the Vehicle

Upon receiving the keys to your rental car, take a few moments to inspect the vehicle for any pre-existing damage. Note any scratches, dents, or other issues, and be sure to document them with the rental company before driving off the lot. This can help protect you from being held responsible for damage that occurred prior to your rental period. Additionally, familiarize yourself with the operation of the vehicle, including adjusting mirrors, headlights, and other controls.

Returning the Vehicle

When it’s time to return your rental car, be sure to do so according to the terms of your agreement. This may include returning the vehicle to a specific location, refueling the tank to the required level, and returning any additional equipment, such as GPS devices or child seats. Take a final walk-around inspection to ensure the vehicle is in the same condition as when you received it, and be prepared to settle any outstanding charges or fees.

Planning Ahead for Your Next Rental

As you wrap up your current rental experience, take note of any lessons learned or areas for improvement. Whether it’s upgrading to a larger vehicle for added comfort or opting for a different insurance option for greater peace of mind, use your experience to inform future rental decisions. By planning ahead and understanding the requirements and considerations involved in renting a car, you can enjoy a seamless and stress-free travel experience.

Certainly! Here’s the article:

Exploring the World of No Credit Check Car Rentals

Understanding the Concept

No credit check car rentals offer a convenient option for individuals who may have limited or poor credit history. Unlike traditional car rental companies that require a credit check as part of the rental process, these providers allow renters to secure a rental vehicle without undergoing a credit check.

Accessible Option

For individuals who have experienced financial difficulties or who have a limited credit history, traditional car rental companies may pose challenges due to their credit check requirements. No credit check car rentals provide an accessible alternative, allowing renters to bypass the credit check process and secure a rental vehicle based on other criteria, such as proof of income or a valid driver’s license.

Rental Process

The rental process for no credit check car rentals is typically straightforward and streamlined. Renters are required to provide basic information, such as their name, address, and contact details, as well as proof of identity and insurance. Some rental companies may also require proof of income or a security deposit to secure the rental.

Documentation Requirements

While no credit check car rentals do not require a credit check, renters must still meet certain documentation requirements to qualify for a rental. This may include providing a valid driver’s license, proof of insurance, and proof of identity. Renters should review the documentation requirements of their chosen rental company before booking a rental to ensure they have everything they need to complete the rental process.

Alternative Criteria

In lieu of a credit check, no credit check car rental companies may use alternative criteria to assess a renter’s eligibility for a rental. This may include reviewing a renter’s driving history, employment status, or rental history. By considering these alternative criteria, renters with limited or poor credit history can still qualify for a rental vehicle and enjoy the benefits of car rental services.

Cost Considerations

While no credit check car rentals offer accessibility and convenience, renters should be aware that they may come with additional costs compared to traditional car rentals. Rental companies may charge higher rental rates, security deposits, or fees to offset the perceived risk of renting to individuals without a credit check. Renters should carefully review the rental terms and conditions and consider any additional costs before booking a rental.

Insurance Options

No credit check car rental companies typically offer insurance options to protect renters and the rental vehicle in the event of accidents, theft, or damage. Renters should carefully review the insurance options provided by their chosen rental company and consider their individual needs before opting for coverage. Additionally, renters may also have the option to use their own insurance coverage or purchase supplemental insurance from a third-party provider.

Customer Experience

Renters who choose no credit check car rentals can expect a customer-centric experience focused on accessibility and convenience. Rental companies may offer flexible rental terms, convenient pickup and drop-off locations, and responsive customer support to ensure a positive rental experience for all renters. By prioritizing customer satisfaction, rental companies aim to provide a seamless and hassle-free rental experience for renters of all backgrounds.

Planning Ahead

Before booking a no credit check car rental, renters should take the time to research their options and familiarize themselves with the rental terms and conditions. This includes reviewing documentation requirements, understanding alternative criteria for qualification, and considering any additional costs associated with the rental. By planning ahead and being informed, renters can enjoy a smooth and stress-free rental experience with no credit check car rentals.

Embracing Accessibility

No credit check car rentals offer an accessible option for individuals who may have limited or poor credit history. By providing an alternative to traditional car rental companies’ credit check requirements, these providers enable renters to secure a rental vehicle based on other criteria and enjoy the convenience of car rental services without the barriers imposed by credit checks.

Categories

Recent Posts

- 4 Tips to Introduce Poultry Grit to Your Chicks and Adult Birds the Right Way

- The Role of Tradition in German Royal Engagement Ring Design

- Battle of the Additives: Comparing B12 Chemtool and Seafoam for Engine Care

- The Ultimate Guide to Auto Repair: Everything You Need to Know

- Virtual Assistant Medical Billing: A Modern Approach to Healthcare Finances

- Total visitors : 9,666

- Total page views: 15,004

Archives

- April 2025

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- February 2024

- January 2024

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017