)

)

Understanding Auto Loan Interest Rates

Auto loan interest rates play a crucial role in determining the overall cost of financing a car purchase. Understanding how these rates work can help you find the best deals and save money over time.

Factors Affecting Interest Rates

Several factors influence auto loan interest rates, including your credit score, the loan term, the type of vehicle you’re purchasing, and current market conditions. Lenders use these factors to assess the risk of lending to you and determine the interest rate accordingly.

The Impact of Credit Scores

Your credit score is one of the most significant factors affecting the interest rate you’ll receive on an auto loan. Generally, the higher your credit score, the lower your interest rate will be. Borrowers with excellent credit scores typically qualify for the best rates, while those with poor credit may face higher rates or struggle to obtain financing.

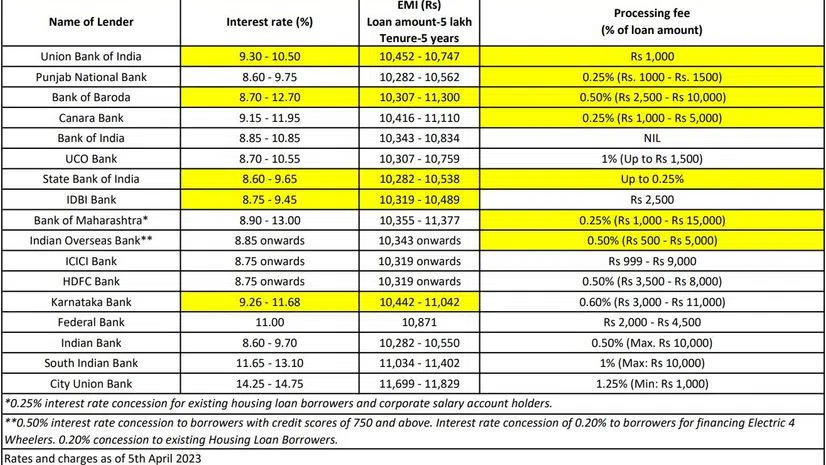

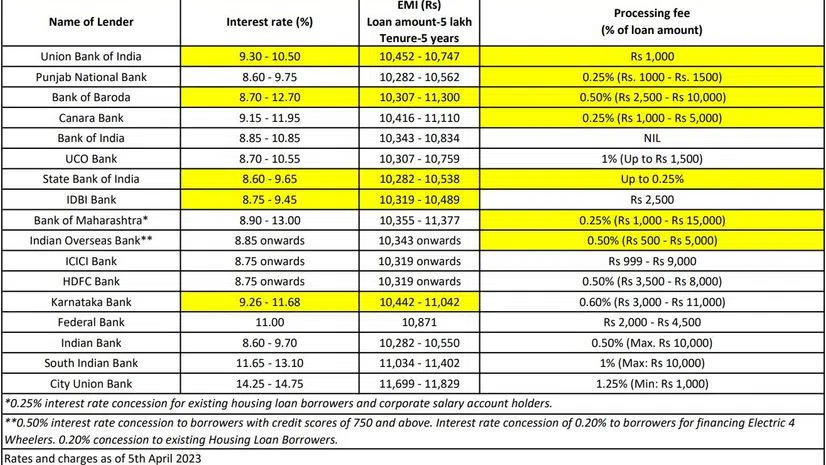

Shopping Around for the Best Rates

When financing a car purchase, it’s essential to shop around and compare interest rates from multiple lenders. This includes banks, credit unions, online lenders, and dealership financing. By exploring different options, you can find the most competitive rates available to you.

Understanding Fixed vs. Variable Rates

Auto loan interest rates can be either fixed or variable. Fixed rates remain the same throughout the life of the loan, providing stability and predictability in monthly payments. Variable rates, on the other hand, can fluctuate over time based on changes in the market, potentially affecting your monthly payments.

The Importance of Loan Term

The length of your loan term also affects the interest rate you’ll pay. Generally, shorter loan terms come with lower interest rates but higher monthly payments, while longer loan terms may have higher rates but lower monthly payments. It’s essential to find a balance between a term that fits your budget and one that minimizes interest costs.

Negotiating Interest Rates

When obtaining auto financing, don’t hesitate to negotiate the interest rate with the lender. If you have a strong credit history or are a loyal customer, you may be able to secure a lower rate than initially offered. Additionally, pre-approval from multiple lenders can give you leverage in negotiations.

Considering Down Payments and Trade-Ins

Making a larger down payment or trading in your current vehicle can help lower the interest rate on your auto loan. A larger down payment reduces the amount you need to borrow, while a trade-in can decrease the overall loan amount, both of which can result in a lower interest rate.

Being Aware of Special Offers

Keep an eye out for special financing offers from manufacturers or dealerships. These promotions may include low or zero-percent interest rates for qualified buyers, allowing you to save money on financing costs. However, be sure to read the fine print and understand any terms or conditions associated with these offers.

Monitoring Market Trends

Interest rates are influenced by broader economic factors and market conditions. Keep an eye on interest rate trends and economic indicators to gauge when it may be a favorable time to secure auto financing. Timing your purchase when rates are low can result in significant savings over the life of the loan.

Seeking Professional Advice

If you’re unsure about which auto loan option is best for you or how interest rates may impact your financing decisions, consider seeking advice from a financial advisor or loan expert. They can provide personalized guidance based on your individual financial situation and goals.

Understanding auto loan interest rates and how they impact the cost of financing a car purchase is essential for making informed decisions. By considering factors like credit scores, shopping around for the best rates, and exploring different financing options, you can secure a loan that fits your needs and budget.

Recent Posts

- Total visitors : 4,099

- Total page views: 8,445

Categories

- Auction Cars

- Auction Cars

- Auto

- Auto

- Auto Deal

- Auto Deal

- Auto Discount

- Auto Discount

- Auto Mobile

- Auto Mobile

- Auto24 De

- Auto24 De

- Automobile

- Automobile De Germany

- Automobile De Germany

- Automobile Deutschland

- Automobile Deutschland

- Bargain Cars

- Bargain Cars

- Car Auctions In Maryland

- Car Auctions In Maryland

- Car Auctions UK

- Car Auctions UK

- Car Book Value

- Car Book Value

- Car Specials

- Car Specials

- Cars

- Cheap

- Cheap Car Leasing

- Cheap Car Leasing

- Cheap Cars

- Cheap Cars

- Convertible

- Convertible

- General Article

- Inexpensive Cars

- Inexpensive Cars

- Military Auctions

- Military Auctions

- Mobile

- Mobile Auto

- Mobile Auto

- Wholesale Cars

- Wholesale Cars

Archives

- July 2024

- June 2024

- May 2024

- April 2024

- February 2024

- January 2024

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

Domain Category

Marketing

Finance

Sales

Management

Strategy

Innovation

Gambling

Gaming

Roulette

Blackjack

Poker

Slots

Style

Trend

Design

Clothing

Apparel

Couture

Cleaning

Plumbing

Electrical

Carpentry

Painting

Gardening

Wellness

Fitness

Nutrition

Exercise

Diet

Hygiene

House

Home

Residence

Abode

Dwelling

Domicile

Habitat

Homestead

Coverage

Policy

Premium

Deductible

Claim

Insured

Adventure

Wanderlust

Explore

Journey

Destination

Trip

Claim