Navigating Mishaps: Understanding Collision Damage Waiver

Essential Protection

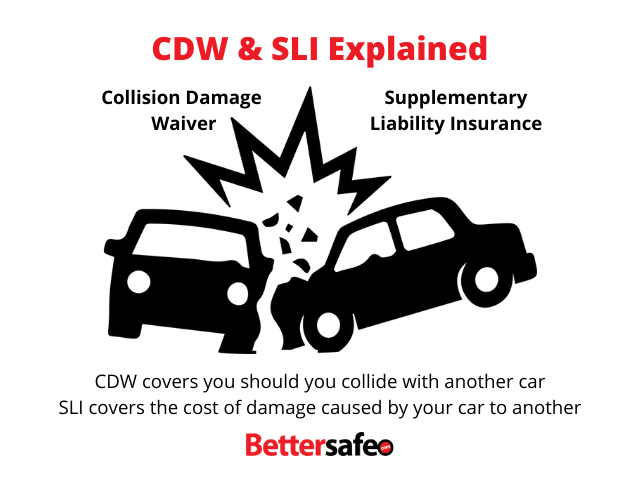

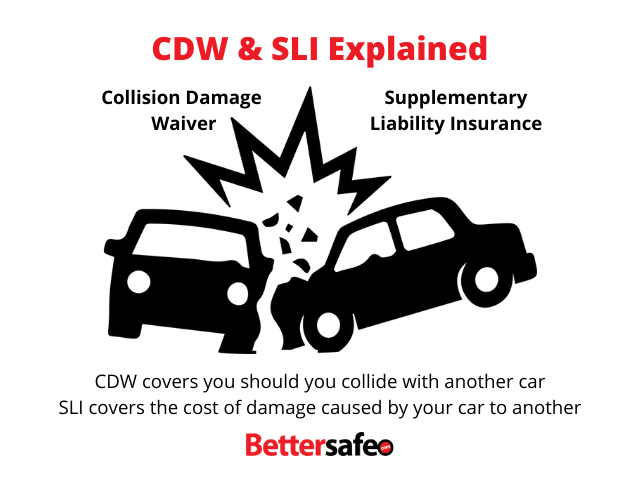

Collision damage waiver (CDW) is a crucial aspect of renting a car, providing protection against financial liabilities in the event of an accident or damage to the rental vehicle. This waiver relieves the renter of responsibility for paying for damages resulting from collisions, theft, or vandalism, offering peace of mind and security throughout the rental period.

Comprehensive Coverage

CDW typically covers damage to the rental vehicle, including repairs or replacement costs, as well as loss due to theft or vandalism. Additionally, some CDW policies may also include coverage for towing expenses, rental car insurance deductibles, and administrative fees associated with processing claims. By opting for CDW, renters can enjoy comprehensive protection against a wide range of potential risks.

Understanding Exclusions

While CDW offers valuable protection, it’s essential to understand the exclusions and limitations of the policy. Most CDW policies do not cover damage to tires, windows, or the interior of the vehicle, nor do they cover accidents resulting from reckless or negligent driving. Additionally, certain types of vehicles, such as luxury or exotic cars, may be excluded from CDW coverage.

Navigating Rental Agreements

When renting a car, it’s crucial to carefully review the rental agreement to understand the terms and conditions of the CDW policy. Pay close attention to any exclusions, limitations, or deductible amounts that may apply, as well as any additional coverage options available for purchase. By familiarizing yourself with the rental agreement upfront, you can make informed decisions and avoid surprises in the event of an accident.

Cost Considerations

While CDW offers invaluable protection, it’s essential to consider the cost associated with purchasing coverage. Rental companies typically offer CDW as an optional add-on at an additional daily or weekly rate, which can vary depending on factors such as the type of vehicle rented and the duration of the rental period. Before making a decision, evaluate the cost-effectiveness of CDW coverage in relation to the potential risks and expenses associated with accidents or damage.

Booking Your Protection

Ready to secure your rental car and protect your journey with collision damage waiver? Look no further than Collision Damage Waiver from OffRoadTaxi.net. With comprehensive coverage options available, OffRoadTaxi.net makes it easy to add CDW to your rental reservation and enjoy peace of mind throughout your travels. Plus, with transparent pricing and flexible coverage options, you can book with confidence, knowing that your insurance needs are covered.

Navigating Your Journey with Confidence

With collision damage waiver in place, you can navigate your journey with confidence, knowing that you’re protected against unforeseen mishaps and financial liabilities. Whether exploring bustling cities, traversing scenic landscapes, or embarking on road trips, your rental vehicle becomes a trusted ally, providing security and assurance every step of the way.

Experience the Peace of Mind

Experience the peace of mind and security that come with collision damage waiver from OffRoadTaxi.net. With comprehensive coverage options and affordable rates, OffRoadTaxi.net ensures that you can enjoy your travels without worrying about potential risks or liabilities. Don’t leave your journey to chance—protect your adventure with collision damage waiver today and travel with confidence.

Navigating the World of Rental Car Insurance

Understanding Your Options

When embarking on a journey, whether for business or pleasure, renting a car can be a convenient and flexible choice. However, alongside the excitement of travel comes the responsibility of ensuring you’re adequately covered in case of any unforeseen events. One of the key decisions you’ll face at the rental counter is whether to opt for insurance coverage offered by the rental company or rely on your existing policies.

The Rental Company’s Offerings

Rental car companies typically provide several insurance options, ranging from basic coverage to comprehensive plans. These offerings often include Collision Damage Waiver (CDW), which limits your liability for damage to the rental vehicle, as well as Loss Damage Waiver (LDW), which covers theft of the vehicle. While these options provide peace of mind, they can significantly add to the overall cost of your rental.

Your Personal Insurance Policies

Before accepting the rental company’s insurance, it’s essential to review your existing insurance policies. Many personal auto insurance policies extend coverage to rental vehicles, at least within the same country. Additionally, credit card companies often offer rental car insurance as a benefit if you use their card to pay for the rental. However, the extent of coverage varies depending on the provider and the specific terms of your policy.

Considerations for International Travel

If you’re renting a car in a foreign country, the rules and regulations regarding insurance may differ from what you’re accustomed to at home. It’s crucial to research the requirements of the country you’ll be visiting and understand whether your existing coverage applies. In some cases, purchasing insurance directly from the rental company may be the most straightforward option to ensure you’re adequately protected during your travels.

The Importance of Comprehensive Coverage

While basic insurance options offered by rental companies can provide a level of protection, they may not cover all potential risks. Comprehensive insurance, such as that offered by Offroad Taxi, provides an additional layer of security by encompassing a wider range of scenarios, including damage due to vandalism, natural disasters, or third-party liability. By investing in comprehensive coverage, you can enjoy greater peace of mind knowing that you’re safeguarded against unforeseen events that may arise during your rental period.

Making an Informed Decision

Ultimately, the decision whether to purchase insurance from the rental company or rely on existing coverage depends on various factors, including the level of risk you’re comfortable with, the specifics of your personal insurance policies, and the nature of your travel plans. Taking the time to understand your options and assess your needs can help you make an informed decision that ensures you’re adequately protected without overspending on unnecessary coverage.

Final Thoughts

Renting a car can enhance your travel experience by providing freedom and flexibility to explore new destinations at your own pace. However, it’s essential to prioritize safety and financial security by ensuring you have the appropriate insurance coverage in place. Whether you choose to rely on existing policies or opt for additional coverage from the rental company, taking proactive steps to protect yourself and your fellow travelers can help mitigate potential risks and ensure a smooth and enjoyable journey.

Categories

- Art & Entertaiment

- Auction Cars

- Auction Cars

- Auto

- Auto

- Auto Deal

- Auto Deal

- Auto Discount

- Auto Discount

- Auto Mobile

- Auto Mobile

- Auto24 De

- Auto24 De

- Automobile

- Automobile De Germany

- Automobile De Germany

- Automobile Deutschland

- Automobile Deutschland

- Automotive

- Bargain Cars

- Bargain Cars

- Business & Economic

- Business Product

- Business Service

- Car Auctions In Maryland

- Car Auctions In Maryland

- Car Auctions UK

- Car Auctions UK

- Car Book Value

- Car Book Value

- Car Specials

- Car Specials

- Cars

- Cheap

- Cheap Car Leasing

- Cheap Car Leasing

- Cheap Cars

- Cheap Cars

- Convertible

- Convertible

- Education & Science

- Fashion & Shopping

- Finance

- Food & Travel

- General Article

- Health

- Home

- Industry & Manufacture

- Inexpensive Cars

- Inexpensive Cars

- Law & Legal

- Military Auctions

- Military Auctions

- Mobile

- Mobile Auto

- Mobile Auto

- Parenting & Family

- Pet & Animal

- Real Estate & Construction

- Sport & Hobby

- Technology & SaaS

- Wholesale Cars

- Wholesale Cars

Recent Posts

- Power and Sustainability Exploring Plug-In Hybrid Cars

- Unveiling Volvo C40 Recharge Pure Electric Luxury SUV

- Conflict Resolution in the Workplace (HR)

- The Iconic Toyota Prius Pioneering Hybrid Excellence

- Used Hybrid Cars Your Eco-Friendly Choice

- Wholesale Fashion Accessories Latest Trends

- Rewind The Hottest 90s Fashion Accessories

- Texas Financial Advice What You Need to Know

- Miss Peaches Ready for Her Forever Family

- The New Face of Portraits Fresh Perspectives

- EQS SUV Price Guide Unveiling Mercedes’ Latest Offering

- Volvo Electric Driving Towards a Sustainable Future

- Bitcoin’s Future What’s Next for Crypto King?

- Introducing Tucson Hybrid Eco-Friendly SUV Innovation

- Unlocking Research New Grants for Academic Publishing

- DIY Halloween Costumes Creative & Budget-Friendly

- Understanding Modern Real Estate Finances

- Quality Control Analyst Ensuring Product Excellence

- Quality Control Specialist Your Path to a Secure Career

- Modern Furniture Fresh Styles for Your Home