Understanding Texas’s Unique Financial Landscape

Texas boasts a diverse economy, ranging from bustling urban centers to sprawling agricultural lands. This variety impacts financial planning significantly. High-growth areas like Austin and Dallas present unique opportunities and challenges, whereas rural areas may have different priorities like land management and agricultural financing. Understanding your specific region within Texas is crucial for effective financial planning.

Taxes in Texas: A Key Consideration

Texas is one of only a few states without a state income tax. This is a significant advantage, allowing more disposable income. However, property taxes can be substantial, especially in rapidly appreciating areas. Sales tax is also a considerable factor in your overall financial picture. Understanding the interplay of property, sales, and federal taxes is crucial to managing your finances effectively in Texas.

Real Estate in the Lone Star State

Real estate is a major component of many Texans’ financial portfolios. The market can be highly competitive, particularly in major cities. Property values fluctuate, so it’s vital to have a clear understanding of market trends before making any significant investment decisions. Working with a qualified real estate agent and financial advisor is crucial to navigating this market successfully.

The Importance of Retirement Planning in Texas

While Texas has no state income tax, retirement planning remains critical. Healthcare costs can be significant, and social security alone might not be sufficient. Consider diversifying your retirement investments and exploring options like 401(k)s, IRAs, and Texas-specific retirement plans to ensure a secure financial future.

Navigating Healthcare Costs in Texas

Healthcare is a significant expense in any state, and Texas is no exception. The cost of insurance and medical care can vary widely depending on your location and health status. Understanding your healthcare options, including employer-sponsored plans, the Affordable Care Act marketplace, and Medicare/Medicaid, is vital to managing your budget effectively. Planning for potential long-term care needs is also essential.

Insurance Needs for Texas Residents

Adequate insurance coverage is essential in Texas. Homeowners insurance is critical to protect your property, especially considering the state’s susceptibility to severe weather events. Auto insurance is mandatory, and the costs can vary depending on your driving record and location. Consider umbrella insurance for additional liability protection. Life insurance is also important for ensuring your family’s financial security.

Investing Wisely in the Texas Market

Texas offers diverse investment opportunities, from energy to technology. However, it’s important to diversify your portfolio and invest prudently. Consider working with a financial advisor who understands the Texas market and can help you create a personalized investment strategy aligned with your risk tolerance and financial goals. Stay informed about market trends and regulations to make informed decisions.

Seeking Professional Financial Guidance

Given the complexities of the Texas financial landscape, seeking professional advice is highly recommended. A certified financial planner (CFP) or other qualified financial advisor can provide personalized guidance tailored to your specific circumstances. They can help you navigate tax implications, create a retirement plan, and develop a comprehensive financial strategy to achieve your goals.

Education and Resources for Financial Literacy

Improving your financial literacy is crucial for long-term financial well-being. Numerous resources are available, including online courses, workshops, and financial literacy programs offered by community organizations and government agencies. Taking advantage of these resources can empower you to make informed financial decisions and build a strong financial foundation.

The Ever-Changing Texas Economy and Its Impact

The Texas economy is dynamic and constantly evolving. Staying abreast of economic trends and their potential impact on your financial situation is crucial. Regularly review your financial plan and make adjustments as needed to adapt to changing circumstances. Staying informed through reputable news sources and professional advice is key to navigating the economic fluctuations. Read more about Texas financial advisory.

)

)

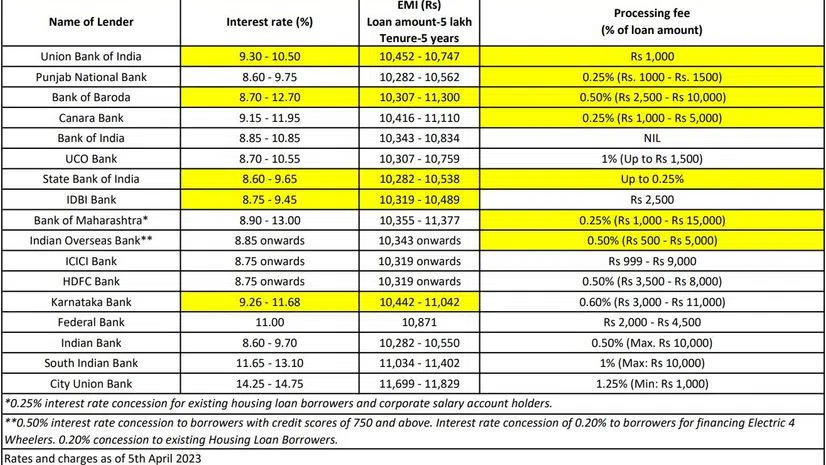

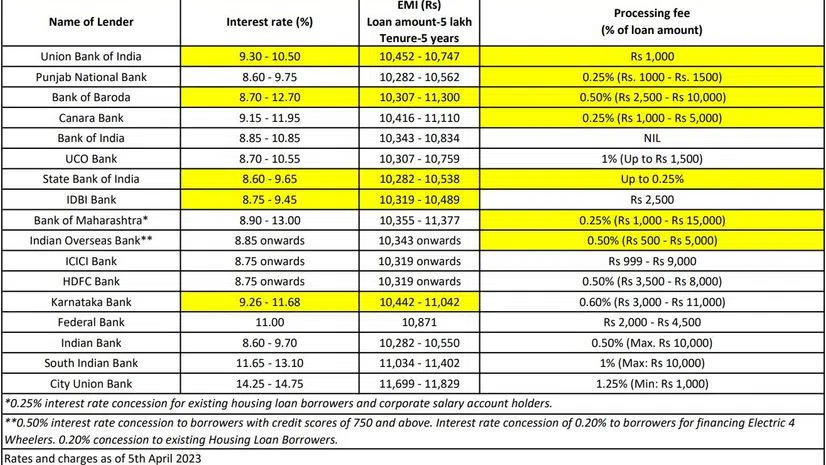

Understanding Auto Loan Interest Rates

Auto loan interest rates play a crucial role in determining the overall cost of financing a car purchase. Understanding how these rates work can help you find the best deals and save money over time.

Factors Affecting Interest Rates

Several factors influence auto loan interest rates, including your credit score, the loan term, the type of vehicle you’re purchasing, and current market conditions. Lenders use these factors to assess the risk of lending to you and determine the interest rate accordingly.

The Impact of Credit Scores

Your credit score is one of the most significant factors affecting the interest rate you’ll receive on an auto loan. Generally, the higher your credit score, the lower your interest rate will be. Borrowers with excellent credit scores typically qualify for the best rates, while those with poor credit may face higher rates or struggle to obtain financing.

Shopping Around for the Best Rates

When financing a car purchase, it’s essential to shop around and compare interest rates from multiple lenders. This includes banks, credit unions, online lenders, and dealership financing. By exploring different options, you can find the most competitive rates available to you.

Understanding Fixed vs. Variable Rates

Auto loan interest rates can be either fixed or variable. Fixed rates remain the same throughout the life of the loan, providing stability and predictability in monthly payments. Variable rates, on the other hand, can fluctuate over time based on changes in the market, potentially affecting your monthly payments.

The Importance of Loan Term

The length of your loan term also affects the interest rate you’ll pay. Generally, shorter loan terms come with lower interest rates but higher monthly payments, while longer loan terms may have higher rates but lower monthly payments. It’s essential to find a balance between a term that fits your budget and one that minimizes interest costs.

Negotiating Interest Rates

When obtaining auto financing, don’t hesitate to negotiate the interest rate with the lender. If you have a strong credit history or are a loyal customer, you may be able to secure a lower rate than initially offered. Additionally, pre-approval from multiple lenders can give you leverage in negotiations.

Considering Down Payments and Trade-Ins

Making a larger down payment or trading in your current vehicle can help lower the interest rate on your auto loan. A larger down payment reduces the amount you need to borrow, while a trade-in can decrease the overall loan amount, both of which can result in a lower interest rate.

Being Aware of Special Offers

Keep an eye out for special financing offers from manufacturers or dealerships. These promotions may include low or zero-percent interest rates for qualified buyers, allowing you to save money on financing costs. However, be sure to read the fine print and understand any terms or conditions associated with these offers.

Monitoring Market Trends

Interest rates are influenced by broader economic factors and market conditions. Keep an eye on interest rate trends and economic indicators to gauge when it may be a favorable time to secure auto financing. Timing your purchase when rates are low can result in significant savings over the life of the loan.

Seeking Professional Advice

If you’re unsure about which auto loan option is best for you or how interest rates may impact your financing decisions, consider seeking advice from a financial advisor or loan expert. They can provide personalized guidance based on your individual financial situation and goals.

Understanding auto loan interest rates and how they impact the cost of financing a car purchase is essential for making informed decisions. By considering factors like credit scores, shopping around for the best rates, and exploring different financing options, you can secure a loan that fits your needs and budget.

Categories

- Art & Entertaiment

- Auction Cars

- Auction Cars

- Auto

- Auto

- Auto Deal

- Auto Deal

- Auto Discount

- Auto Discount

- Auto Mobile

- Auto Mobile

- Auto24 De

- Auto24 De

- Automobile

- Automobile De Germany

- Automobile De Germany

- Automobile Deutschland

- Automobile Deutschland

- Automotive

- Bargain Cars

- Bargain Cars

- Business & Economic

- Business Product

- Business Service

- Car Auctions In Maryland

- Car Auctions In Maryland

- Car Auctions UK

- Car Auctions UK

- Car Book Value

- Car Book Value

- Car Specials

- Car Specials

- Cars

- Cheap

- Cheap Car Leasing

- Cheap Car Leasing

- Cheap Cars

- Cheap Cars

- Convertible

- Convertible

- Education & Science

- Fashion & Shopping

- Finance

- Food & Travel

- General Article

- Health

- Home

- Industry & Manufacture

- Inexpensive Cars

- Inexpensive Cars

- Law & Legal

- Military Auctions

- Military Auctions

- Mobile

- Mobile Auto

- Mobile Auto

- Parenting & Family

- Pet & Animal

- Real Estate & Construction

- Sport & Hobby

- Technology & SaaS

- Wholesale Cars

- Wholesale Cars

Recent Posts

- Embrace the Future EV SUVs for Eco-Conscious Drivers

- Power and Sustainability Exploring Plug-In Hybrid Cars

- Unveiling Volvo C40 Recharge Pure Electric Luxury SUV

- Conflict Resolution in the Workplace (HR)

- The Iconic Toyota Prius Pioneering Hybrid Excellence

- Used Hybrid Cars Your Eco-Friendly Choice

- Wholesale Fashion Accessories Latest Trends

- Rewind The Hottest 90s Fashion Accessories

- Texas Financial Advice What You Need to Know

- Miss Peaches Ready for Her Forever Family

- The New Face of Portraits Fresh Perspectives

- EQS SUV Price Guide Unveiling Mercedes’ Latest Offering

- Volvo Electric Driving Towards a Sustainable Future

- Bitcoin’s Future What’s Next for Crypto King?

- Introducing Tucson Hybrid Eco-Friendly SUV Innovation

- Unlocking Research New Grants for Academic Publishing

- DIY Halloween Costumes Creative & Budget-Friendly

- Understanding Modern Real Estate Finances

- Quality Control Analyst Ensuring Product Excellence

- Quality Control Specialist Your Path to a Secure Career