Ensure Peak Performance with Nissan Altima 2015 Maintenance

Rusty May 12, 2024 ArticleEnsure Peak Performance with Nissan Altima 2015 Maintenance

Your Nissan Altima 2015 is more than just a car; it’s a companion on your daily journey. To ensure it remains a reliable and efficient partner, proper maintenance is key. Let’s delve into the essential aspects of maintaining your Altima 2015 and unlocking its peak performance.

Timely Maintenance: The Backbone of Longevity

Just like our bodies need regular check-ups for optimal health, your Altima 2015 requires timely maintenance for its longevity. Regular servicing helps identify potential issues before they escalate, ensuring your vehicle operates smoothly and efficiently.

Maximize Reliability: A Maintenance Guide

Reliability is the hallmark of a great vehicle, and your Altima 2015 is no exception. Following the manufacturer’s maintenance guide is crucial. It provides insights into scheduled service intervals, recommended fluid changes, and other essential upkeep tasks, allowing you to maximize the reliability of your Altima.

Elevate Your Drive: Prioritizing Maintenance

Maintenance isn’t just about fixing problems; it’s about elevating your driving experience. When you prioritize regular check-ups and adhere to the maintenance schedule, you’re ensuring that every drive in your Altima 2015 is a smooth and enjoyable one.

Unleash Performance: Schedule Maintenance Strategically

To unleash the full potential of your Altima 2015, strategic maintenance scheduling is key. Pay attention to your vehicle’s mileage and the manufacturer’s recommendations. Whether it’s an oil change, brake inspection, or tire rotation, adhering to a well-thought-out maintenance schedule enhances your Altima’s overall performance.

Essential Care: Nissan Altima 2015 Maintenance Tips

Apart from scheduled services, there are day-to-day maintenance tips that can significantly impact your Altima’s well-being. Regularly checking tire pressure, monitoring fluid levels, and keeping an eye on the brakes are simple yet effective ways to ensure your Altima receives the essential care it deserves.

Secure Your Investment: The Importance of Timely Maintenance

Your Altima 2015 is an investment, and like any investment, it requires protection. Timely maintenance not only keeps your vehicle in top condition but also safeguards its resale value. Potential buyers are more inclined towards well-maintained vehicles, making your Altima a secure investment in the long run.

Optimal Driving Experience: Nourishing Your Altima 2015

To maintain an optimal driving experience, it’s crucial to nourish your Altima 2015 with proper care. Regular maintenance checks and addressing issues promptly contribute to a smoother and stress-free driving experience. Your Altima deserves nothing less than the best, and that includes a well-maintained performance.

Keep Rolling Smoothly: Altima 2015 Maintenance Checklist

Create a maintenance checklist tailored to your Altima’s specific needs. Include items like oil changes, filter replacements, brake inspections, and fluid checks. Regularly revisiting this checklist ensures that no aspect of your Altima’s maintenance is overlooked, keeping it rolling smoothly mile after mile.

Prolong Lifespan: Insights into Nissan Altima 2015 Maintenance

Understanding the nuances of Altima 2015 maintenance goes a long way in prolonging its lifespan. Familiarize yourself with the owner’s manual, and take note of the manufacturer’s recommendations. This knowledge empowers you to make informed decisions regarding your Altima’s care and contributes to its longevity.

Proactive Approach: Altima 2015 Maintenance Musts

Adopting a proactive approach to maintenance is the secret to a hassle-free driving experience. Rather than waiting for issues to arise, take preventative measures. Regularly inspect belts, hoses, and the battery, and address any concerns promptly. This proactive stance ensures that your Altima remains a reliable companion on the road.

Drive with Confidence: Altima 2015 Maintenance Essentials

In essence, maintaining your Nissan Altima 2015 is not just a responsibility; it’s a way to drive with confidence. By prioritizing its care, adhering to recommended schedules, and staying proactive, you’re ensuring that every journey in your Altima is a confident and enjoyable one. After all, a well-maintained Altima is a testament to your commitment to quality and performance on the road. Read more about maintenance other nissan altima 2015

Navigating the Maze: Finding Garage Door Repair Services Nearby

The Urgency of Swift Solutions

When your garage door starts acting up, there’s no time to waste. Swift solutions are key. It’s all about finding reliable garage door repair services near you to address issues promptly. Let’s explore how to navigate the maze and get those quick fixes for your garage door hassles.

Proximity Matters

In the realm of garage door repairs, proximity matters. You want a service that can reach you quickly, especially if your garage door issue is causing inconvenience or security concerns. Searching for services nearby ensures that help is on the way without unnecessary delays.

Efficiency in Local Options

Local options often come with the advantage of efficiency. A nearby garage door repair service is familiar with the area, understands local needs, and can respond promptly. Efficiency in service delivery is crucial, especially when dealing with garage door malfunctions that need immediate attention.

Discovering Reliability

Reliability is a non-negotiable factor when seeking garage door repair services. You want a service that not only responds swiftly but also delivers reliable solutions. Look for reviews, testimonials, and recommendations to gauge the reliability of the services available in your vicinity.

Convenience in Quick Fixes

The convenience of quick fixes cannot be overstated. Garage door issues can disrupt your daily routine, and a prompt solution is essential. Finding a service nearby ensures that the inconvenience is minimized, and your garage door is back to its functional state sooner rather than later.

Ease of Accessibility

Accessibility is a significant factor when selecting garage door repair services. You want a service that is easy to reach and communicate with. Local services often provide a level of accessibility that ensures clear communication and a straightforward process from inquiry to repair completion.

Local Expertise

Local garage door repair services bring with them a wealth of local expertise. They understand the common issues faced by homeowners in the area, the specific weather conditions, and the type of garage doors prevalent. This local expertise can translate into more effective and tailored solutions for your garage door problems.

Avoiding Unnecessary Delays

The last thing you want when dealing with a malfunctioning garage door is unnecessary delays. Opting for a service nearby helps in avoiding these delays. Whether it’s a broken spring, malfunctioning opener, or any other issue, quick proximity-based solutions save time and frustration.

Swift Solutions for Peace of Mind

Swift solutions not only address the immediate issue but also provide peace of mind. Knowing that a reliable and efficient garage door repair service is nearby offers a sense of security. It’s about having a go-to resource for any future garage door hiccups that might come your way.

Navigating the Maze Successfully

In the quest for garage door repair services nearby, consider factors like proximity, reliability, efficiency, and local expertise. It’s about navigating the maze successfully to find a service that not only meets your immediate needs but also becomes your go-to solution for any future garage door troubles. Swift solutions and local reliability – that’s the winning combination for a hassle-free garage door experience. Read more about find garage door repair services near me

Getting Behind the Wheel: A Savvy Guide to Buying a Used Car

So, you’re in the market for a used car, and you want to make sure you’re not driving off with a lemon. Smart move! Buying a used car can be a fantastic way to save some bucks, but it comes with its own set of challenges. Fear not, though – we’ve got a guide to help you navigate the process with confidence.

Inspecting the Exterior: Eyes on the Prize

The first thing you notice about a car is its exterior, right? Well, when buying used, it’s not just about aesthetics. Take a stroll around the car, keeping an eye out for any signs of damage, rust, or mismatched paint. Check the panels for consistency, and don’t forget to scrutinize the tires – uneven wear could signal alignment issues.

Under the Hood: The Heart of the Matter

Now, let’s pop the hood and get to the nitty-gritty. Look for any leaks, odd smells, or frayed wires. Check the oil – it should be clean and at the right level. Peek at the transmission fluid too. Don’t worry; you don’t need to be a mechanic to do this – just a keen eye and a willingness to get your hands a bit dirty.

Taking a Test Drive: Feel the Road

This is where the rubber meets the road – literally. A test drive is your chance to connect with the car on a visceral level. Listen for any strange noises, feel for vibrations, and pay attention to how it handles. Test the brakes and make sure the steering is responsive. A test drive isn’t just a formality; it’s your opportunity to ensure the car feels right for you.

Interior Examination: Where You’ll Spend Your Time

You spend a lot of time inside your car, so make sure it’s a comfortable space. Check the condition of the seats, the functionality of the electronics, and the cleanliness of the interior. Foul odors or excessive wear could be red flags. Don’t forget to inspect the trunk – you never know when you’ll need that extra cargo space.

Paperwork Parade: Check the Documents

Before you sign on the dotted line, it’s crucial to go through the paperwork. Ask for maintenance records, service history, and any repair documentation. A well-documented car is a sign of a responsible owner. Verify the vehicle identification number (VIN) on the paperwork matches the one on the car. This step ensures you’re not dealing with a case of identity theft in the automotive world.

Research and Reviews: The Power of Knowledge

With the internet at your fingertips, there’s no excuse not to do your homework. Look up reviews for the make and model you’re considering. Check for common issues, recalls, and the overall reputation of the car. Websites, forums, and independent reviews can be treasure troves of information, providing insights from real owners.

Setting a Budget: Dollars and Sense

Before you start shopping, set a realistic budget. Consider not only the upfront cost but also potential maintenance and insurance expenses. Don’t stretch your finances too thin; it’s better to find a reliable, affordable option within your means. Knowing your budget helps narrow down your choices and ensures you don’t fall in love with a car that’s way out of your price range.

Negotiation Tactics: Haggling 101

Negotiating the price is part of the used car buying dance. Be prepared to haggle, but do it smartly. Know the market value of the car, use any identified issues during inspection as leverage, and be willing to walk away if the deal doesn’t meet your expectations. Remember, it’s your money, and you have the power to make the final call.

Vehicle History Reports: The Detective Work

Before you commit, consider investing in a vehicle history report. These reports provide a detailed background of the car, including any accidents, title issues, or odometer discrepancies. It’s like getting a detective to spill the beans on the car’s past. Armed with this information, you can make a more informed decision.

Mechanic’s Approval: The Seal of Expertise

If you’re not car-savvy, bring in the experts. Having a trusted mechanic inspect the car before purchase can save you from potential headaches. They can spot issues you might miss and provide an unbiased opinion. Sure, it might cost a bit upfront, but it’s a small price to pay for peace of mind.

Buying a used car doesn’t have to be a nerve-wracking experience. Armed with these tips, you’ll be ready to hit the road in a reliable set of wheels. Happy driving! Read more about things to check while buying used car

Late-Night Garage Door Maintenance: Keep Your Doors Rolling Smoothly

The Importance of After-Hours TLC

Maintaining your garage door might not be the first thing on your late-night to-do list, but it’s a crucial task that ensures the smooth operation and longevity of this essential part of your home. Late-night garage door maintenance isn’t just a chore – it’s a proactive step to prevent potential issues and keep things running smoothly.

Why Late Night?

Late-night maintenance might seem unconventional, but it has its perks. The peace and quiet of the late hours provide an ideal environment for thorough checks and adjustments. Plus, you won’t disturb your neighbors with the occasional squeaks and clicks that are part of the maintenance process.

Start with a Visual Inspection

Turn on the garage lights and take a close look at your door. Check for any signs of wear and tear, rust, or damage. Pay attention to the tracks, rollers, and hinges. Look for loose bolts or screws and tighten them as needed. A visual inspection is the first step to catch any issues before they escalate.

Lubricate Moving Parts

Late-night is the perfect time to show some love to the moving parts of your garage door. Using a silicone-based lubricant, grease up the rollers, hinges, and springs. This simple step can significantly reduce friction, minimize wear, and keep your garage door operating quietly.

Tighten Up Hardware

Garage doors can shake things up, quite literally. All the movement can lead to bolts and screws loosening over time. Take a wrench and tighten up any loose hardware you find. This not only ensures smooth operation but also enhances the safety of your garage door.

Balance Check for Smooth Operation

An unbalanced garage door can lead to uneven wear and tear on various components. To check the balance, close the door and disconnect the automatic opener. Manually lift the door halfway – it should stay in place. If it doesn’t, you might need to adjust the tension in the springs or call in a professional for assistance.

Inspect and Replace Weather Stripping

Weather stripping plays a crucial role in keeping your garage well-insulated and protected from the elements. Check for any signs of wear or damage and replace weather stripping as needed. This small step can make a significant difference in energy efficiency.

Test the Auto-Reverse Safety Feature

All modern garage doors are equipped with an auto-reverse safety feature. Test this feature by placing a small object, like a wooden block, on the ground in the door’s path. Close the door – it should automatically reverse upon hitting the object. This test ensures that the safety mechanism is functioning correctly.

Check the Cables

Safety is paramount when it comes to garage doors. Inspect the cables for any fraying or damage. If you notice any issues, it’s crucial to call in a professional for repairs. Attempting to fix cable problems without proper knowledge can be dangerous.

Clean the Tracks

Dirt and debris can accumulate in the tracks over time, affecting the smooth movement of your garage door. Use a damp cloth to clean the tracks thoroughly. Make sure to remove any obstructions that might be hindering the door’s operation.

Final Checks for Peace of Mind

Before wrapping up your late-night garage door maintenance routine, do a final check. Listen for any unusual sounds during the door’s operation, ensure that the safety features are working correctly, and test the automatic opener for smooth functioning. These final checks provide peace of mind and confirm that your garage door is in top-notch condition.

By incorporating these late-night garage door maintenance tips into your routine, you’re not just ensuring the longevity of your garage door but also contributing to a quieter and safer home environment. Remember, a little late-night TLC goes a long way in keeping your garage door rolling smoothly for years to come. Read more about garage door maintenance in late night

Unveiling the World of Certified Used Cars

Certified used cars have become increasingly popular among car buyers seeking quality and peace of mind. Let’s delve into the realm of certified used cars, exploring what they are, how they’re certified, and why they’re worth considering for your next vehicle purchase.

Understanding Certified Used Cars

Certified used cars are pre-owned vehicles that have undergone a rigorous inspection and certification process by the manufacturer or an authorized dealership. These cars typically come with additional warranty coverage and other benefits, making them an attractive option for buyers looking for reliability and assurance.

Certification Process

The certification process for used cars varies depending on the manufacturer or dealership, but it generally involves a comprehensive inspection of the vehicle’s mechanical, electrical, and cosmetic components. Trained technicians evaluate the car’s condition and ensure it meets the manufacturer’s standards for certification.

Benefits of Certification

One of the primary benefits of certified used cars is the added peace of mind they offer to buyers. Certified vehicles often come with extended warranty coverage, roadside assistance, and other perks, providing buyers with assurance and protection against unexpected repair costs.

Quality Assurance

Certified used cars undergo thorough inspections to ensure they meet high-quality standards set by the manufacturer. These inspections cover various aspects of the vehicle, including its engine, transmission, brakes, tires, and interior features, to ensure it’s in excellent condition and free of significant defects.

Extended Warranty Coverage

Unlike typical used cars, certified used cars often come with extended warranty coverage, providing buyers with additional protection against mechanical failures and defects. This warranty coverage can give buyers peace of mind and save them money on potential repair costs down the road.

Value Retention

Certified used cars tend to retain their value better than non-certified vehicles, making them a smart investment for buyers looking to maximize their resale value. The assurance of certification and warranty coverage can attract more buyers and command higher prices in the resale market.

Manufacturer Support

Buying a certified used car often means gaining access to manufacturer support and resources. Manufacturers may offer special financing rates, incentives, and customer support services to certified car buyers, further enhancing the ownership experience.

Wide Selection

Many manufacturers and dealerships offer a wide selection of certified used cars to choose from, spanning various makes, models, and price ranges. This extensive inventory gives buyers plenty of options to find the perfect certified vehicle to suit their needs and preferences.

Peace of Mind

Above all, certified used cars provide buyers with peace of mind and confidence in their purchase. Knowing that their vehicle has been thoroughly inspected, certified, and backed by warranty coverage can alleviate concerns and allow buyers to enjoy their new car with confidence.

Conclusion

Certified used cars offer a compelling combination of quality, reliability, and value for car buyers. With their rigorous certification process, extended warranty coverage, and other benefits, certified used cars provide peace of mind and assurance to buyers seeking a dependable vehicle for their transportation needs. Explore the world of certified used cars and discover the benefits they offer for your next car purchase.

Absolutely, here’s the article:

Exploring the World of Rental Car Deposits

Understanding the Purpose

Rental car deposits are a standard practice in the car rental industry, serving as a form of security for rental companies. These deposits are designed to protect the rental company against potential damages or losses associated with the rental vehicle during the rental period.

Determining Deposit Amounts

The amount of the rental car deposit can vary depending on several factors, including the rental company, the type of vehicle rented, and the duration of the rental period. In most cases, rental car deposits range from a few hundred to several thousand dollars. Renters should be prepared to provide a deposit equivalent to the estimated total cost of the rental upfront.

Securing the Deposit

To secure the rental car deposit, rental companies typically place a hold on the renter’s credit card at the time of booking or vehicle pickup. This hold temporarily freezes the funds on the credit card, preventing the renter from accessing them until the rental period is complete. Once the vehicle is returned without any damages or losses, the hold is released, and the funds become available again.

Understanding Deposit Refunds

Upon returning the rental vehicle in acceptable condition, renters can expect to receive a refund of their deposit. However, it’s essential to note that the process of refunding the deposit may take several days to weeks, depending on the rental company and the policies of the credit card issuer. Renters should be prepared to wait for the refund to appear on their credit card statement.

Factors Affecting Deposits

Several factors can affect the amount of the rental car deposit and the rental company’s policies regarding deposits. These may include the renter’s age, driving history, and credit score, as well as the type of vehicle rented and the rental location. Additionally, rental companies may impose additional fees or surcharges for certain rental conditions, such as one-way rentals or rentals with a high mileage allowance.

Managing Expectations

Before renting a car, it’s essential for renters to understand the deposit requirements and manage their expectations accordingly. This includes budgeting for the deposit amount and ensuring that sufficient funds are available on the credit card used to secure the rental. Renters should also familiarize themselves with the rental company’s policies regarding deposits, including any potential deductions for damages or losses.

Protecting Yourself

While rental car deposits are a standard part of the rental process, renters can take steps to protect themselves and minimize the risk of unexpected charges. This includes thoroughly inspecting the rental vehicle for any pre-existing damage before accepting it, documenting any issues with photos or videos, and returning the vehicle in the same condition as when it was rented. Additionally, renters may consider purchasing rental car insurance to provide additional coverage and peace of mind during the rental period.

Planning Ahead

By understanding the ins and outs of rental car deposits, renters can navigate the rental process with confidence and peace of mind. By budgeting for the deposit amount, managing expectations regarding refunds, and taking steps to protect themselves, renters can enjoy a smooth and hassle-free rental experience. So, before embarking on your next adventure, be sure to familiarize yourself with rental car deposits and policies to ensure a stress-free journey.

Comprehensive Car Insurance Complete Protection for Your Vehicle

Rusty April 1, 2024 Article

Exploring the Depths of Full Coverage Car Insurance

In the realm of auto insurance, full coverage car insurance stands as the pinnacle of protection for drivers and their vehicles. Let’s dive into the intricacies of full coverage car insurance and uncover why it’s the ultimate safeguard for your vehicle on the road.

Understanding Full Coverage

Full coverage car insurance is a comprehensive insurance policy that combines several types of coverage into one package. Unlike basic liability insurance, which only covers damages to others in an accident, full coverage insurance also provides protection for your own vehicle. This comprehensive approach ensures that you’re covered in a wide range of scenarios, from minor fender-benders to major collisions.

Components of Full Coverage

Full coverage car insurance typically includes three main components: liability coverage, collision coverage, and comprehensive coverage. Liability coverage helps cover the costs of injuries and damages to others if you’re at fault in an accident. Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision with another vehicle or object. Comprehensive coverage protects your vehicle from non-collision incidents such as theft, vandalism, and natural disasters.

Protection Against the Unexpected

One of the primary benefits of full coverage car insurance is its ability to protect you against the unexpected. Whether it’s a minor accident or a major catastrophe, full coverage insurance ensures that you’re financially protected from the consequences. With comprehensive coverage in place, you can drive with confidence, knowing that you’re prepared for whatever the road may bring.

Peace of Mind on the Road

Driving can be unpredictable, with hazards lurking around every corner. With full coverage car insurance, you can drive with peace of mind, knowing that you’re adequately protected against the risks of the road. Whether you’re commuting to work, running errands, or embarking on a road trip, full coverage insurance offers peace of mind every mile of the way.

Tailoring Your Coverage

Full coverage car insurance is highly customizable, allowing you to tailor your coverage to fit your specific needs and budget. You can adjust your coverage limits, deductibles, and add optional extras such as roadside assistance or rental car reimbursement for enhanced protection. Working with an experienced insurance agent can help you find the coverage that’s right for you.

Considering the Costs

While full coverage car insurance offers comprehensive protection, it’s essential to consider the costs involved. Full coverage insurance typically comes with higher premiums than basic liability insurance, reflecting the increased level of protection it provides. However, the peace of mind and financial security it offers are often well worth the investment, especially for drivers with newer or high-value vehicles.

Navigating Coverage Limits

When purchasing full coverage car insurance, you’ll need to consider your coverage limits carefully. These limits represent the maximum amount your insurance company will pay for damages in the event of an accident. It’s essential to choose limits that adequately protect your assets and financial well-being without breaking the bank.

Understanding Deductibles

Full coverage car insurance also comes with deductibles, which represent the amount you’re responsible for paying out of pocket before your insurance kicks in. Higher deductibles typically result in lower premiums, while lower deductibles offer greater financial protection but may come with higher premiums. Finding the right balance is key to maximizing your coverage while keeping costs manageable.

Planning for the Future

In conclusion, full coverage car insurance is the ultimate safeguard for your vehicle on the road. Visit OffRoadTaxi.net to explore full coverage car insurance options and ensure that you’re adequately protected against the unexpected. With full coverage insurance in place, you can drive with confidence, knowing that you’re prepared for whatever the road may bring.

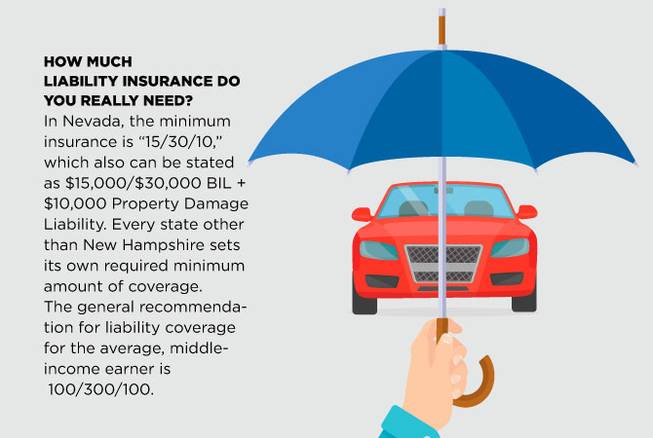

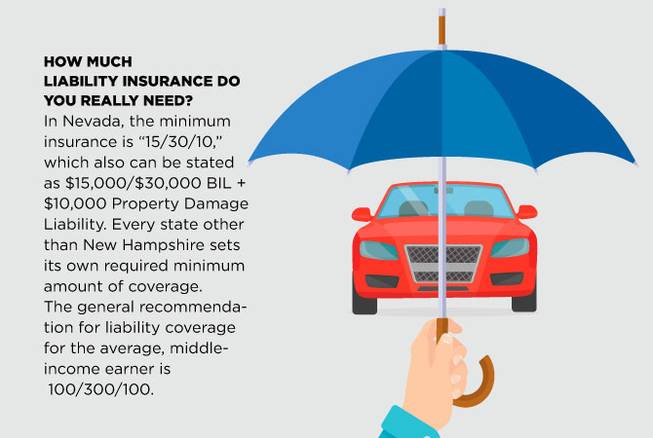

Understanding the Significance of Liability Car Insurance

In the realm of car insurance, liability coverage stands as a cornerstone of protection for drivers. Let’s delve into the intricacies of liability car insurance and explore why it’s essential for safeguarding both drivers and their vehicles on the road.

Protecting Against Financial Loss

Liability car insurance provides financial protection in the event that you’re found responsible for causing an accident. This coverage helps cover the costs of bodily injury and property damage incurred by the other party involved in the accident. Without liability insurance, you could be personally liable for these expenses, which can be substantial and potentially devastating.

Meeting Legal Requirements

In many jurisdictions, liability car insurance is a legal requirement for drivers. It serves as a fundamental aspect of responsible vehicle ownership, ensuring that drivers have the means to compensate others for damages they may cause in an accident. By carrying liability insurance, drivers not only protect themselves but also comply with the law and fulfill their civic duty to other road users.

Understanding Coverage Limits

Liability car insurance comes with coverage limits, which represent the maximum amount your insurance company will pay for damages resulting from an accident. These limits are typically expressed as three numbers, such as 25/50/25, representing bodily injury liability per person, bodily injury liability per accident, and property damage liability per accident, respectively. It’s essential to choose coverage limits that adequately protect your assets and financial well-being.

Supplementing Personal Assets

In addition to providing financial protection, liability car insurance helps shield your personal assets from exposure in the event of a lawsuit. Without adequate insurance coverage, you could be at risk of losing valuable assets such as your home, savings, or future earnings to satisfy a judgment resulting from an accident you caused. Liability insurance acts as a buffer, safeguarding your financial security and providing peace of mind.

Coverage Beyond Medical Bills

While liability insurance primarily covers bodily injury and property damage resulting from an accident, its benefits extend beyond medical bills and repair costs. It can also help cover legal fees and court costs if you’re sued as a result of the accident. This comprehensive protection ensures that you’re not left shouldering the financial burden alone in the aftermath of an accident.

Protecting Your Future

Investing in liability car insurance isn’t just about complying with legal requirements; it’s about protecting your future. Accidents can happen to anyone, regardless of how careful a driver you may be. By carrying liability insurance, you’re taking proactive steps to safeguard your financial stability and ensure that a single accident doesn’t derail your long-term financial goals.

Tailoring Your Coverage

Liability car insurance is highly customizable, allowing you to tailor your coverage to suit your needs and budget. You can adjust your coverage limits and add supplemental coverage options such as uninsured/underinsured motorist coverage or personal injury protection to enhance your protection further. Working with an experienced insurance agent can help you navigate your options and find the coverage that’s right for you.

Assessing Your Risk Factors

When determining your liability insurance needs, it’s essential to assess your risk factors carefully. Factors such as your driving record, the value of your assets, and your financial situation can all influence the level of coverage you require. By evaluating these factors and consulting with insurance professionals, you can ensure that you’re adequately protected against potential risks.

Ensuring Peace of Mind

In conclusion, liability car insurance is a fundamental aspect of responsible vehicle ownership, providing essential protection for drivers and their assets. Visit OffRoadTaxi.net to explore liability car insurance options and secure the coverage you need to drive with confidence on the road. With liability insurance in place, you can rest assured knowing that you’re prepared for whatever the road may bring.

Exploring the Importance of Uninsured Motorist Coverage

In the realm of auto insurance, uninsured motorist coverage stands as a vital safeguard for drivers. Let’s delve into the significance of uninsured motorist coverage and understand why it’s essential to have this protection in place.

Protecting Against the Unforeseen

Uninsured motorist coverage provides financial protection in the event that you’re involved in an accident with a driver who doesn’t have insurance. This coverage ensures that you’re not left bearing the financial burden of medical bills, vehicle repairs, and other expenses resulting from the accident.

Coverage Beyond Liability Insurance

While liability insurance is mandatory for drivers in many states, not all drivers comply with this requirement. Uninsured motorist coverage fills the gap left by uninsured and underinsured drivers, offering you peace of mind knowing that you’re protected against the risks posed by uninsured motorists on the road.

Ensuring Your Peace of Mind

Driving can be unpredictable, with hazards lurking around every corner. Uninsured motorist coverage provides an added layer of security, allowing you to drive with confidence knowing that you’re prepared for the unexpected. With this coverage in place, you can focus on the road ahead without worrying about the financial consequences of an accident with an uninsured driver.

Protecting Your Finances

Accidents can result in significant financial losses, especially if you’re forced to pay out of pocket for medical expenses and vehicle repairs. Uninsured motorist coverage helps safeguard your finances by covering these expenses, ensuring that you’re not left facing a hefty financial burden in the aftermath of an accident.

Covering Medical Expenses

In accidents involving uninsured motorists, medical expenses can quickly add up. Uninsured motorist coverage helps cover the cost of medical treatment for injuries sustained in the accident, including hospital bills, doctor’s fees, and rehabilitation costs. This ensures that you receive the medical care you need without having to worry about the cost.

Protecting Your Vehicle

In addition to covering medical expenses, uninsured motorist coverage also helps cover the cost of repairing or replacing your vehicle if it’s damaged in an accident with an uninsured driver. This ensures that you’re not left without transportation while waiting for repairs or dealing with the aftermath of a totaled vehicle.

Navigating Legal Complexities

Dealing with accidents involving uninsured motorists can be legally complex and time-consuming. Uninsured motorist coverage helps streamline the claims process by providing prompt compensation for your injuries and damages, allowing you to focus on your recovery rather than on legal battles.

Understanding Coverage Limits

When purchasing uninsured motorist coverage, it’s essential to understand your coverage limits. These limits represent the maximum amount your insurance company will pay for damages resulting from an accident with an uninsured motorist. It’s crucial to choose coverage limits that adequately protect your assets and financial well-being.

Tailoring Your Coverage

Uninsured motorist coverage is highly customizable, allowing you to tailor your coverage to fit your specific needs and budget. You can adjust your coverage limits and deductibles to find a balance that provides adequate protection without breaking the bank. Working with an experienced insurance agent can help you navigate your options and find the coverage that’s right for you.

Ensuring Comprehensive Protection

In conclusion, uninsured motorist coverage is a crucial component of auto insurance, offering protection against the financial risks posed by uninsured and underinsured motorists. Visit OffRoadTaxi.net to learn more about uninsured motorist coverage and explore your options for ensuring comprehensive protection on the road.

Driving Without Commitment: Exploring Car Subscription Services

A New Way to Drive

Car subscription services are revolutionizing the way people think about car ownership. Instead of being tied down to a single vehicle for years on end, subscribers have the flexibility to drive a variety of vehicles for a set monthly fee. This innovative approach to car ownership offers freedom and convenience that traditional ownership models can’t match.

Flexibility and Variety

One of the key benefits of car subscription services is the flexibility they offer. Subscribers can choose from a wide variety of vehicles, ranging from compact cars to luxury SUVs, and switch between them as often as they like. Whether you need a practical sedan for your daily commute or a spacious minivan for a family road trip, there’s a vehicle subscription option to suit your needs.

All-Inclusive Pricing

Car subscription services typically include all the costs associated with car ownership, such as insurance, maintenance, and roadside assistance, in one convenient monthly payment. This all-inclusive pricing model means subscribers don’t have to worry about unexpected expenses or hidden fees – everything is taken care of for them.

Seamless Experience

Signing up for a car subscription service is a quick and easy process. Subscribers can usually complete the entire process online, from selecting their desired vehicle to arranging for delivery or pickup. Once subscribed, they can manage their account, schedule vehicle swaps, and make payments through a user-friendly mobile app or website.

No Long-Term Commitment

Unlike traditional car leases or purchases, car subscription services offer subscribers the flexibility to cancel their subscription at any time without penalty. This means subscribers aren’t locked into a long-term commitment and can adjust their subscription as their needs change.

Convenience and Peace of Mind

With a car subscription service, subscribers can enjoy the convenience of having access to a vehicle whenever they need it, without the hassle of ownership. Whether they need a car for a weekend getaway or a last-minute errand, they can simply schedule a vehicle swap and have a car delivered to their doorstep or pick one up from a convenient location.

Customizable Options

Many car subscription services offer customizable subscription plans that allow subscribers to tailor their experience to their specific needs and preferences. Whether they want to add on extra features like car washes or roadside assistance, or adjust their subscription term to better fit their budget, there’s a subscription option for everyone.

Environmental Benefits

By promoting car sharing and reducing the number of cars on the road, car subscription services can help reduce traffic congestion and carbon emissions. Plus, many subscription services offer eco-friendly vehicle options, such as electric or hybrid cars, further contributing to environmental sustainability.

Join the Movement

In conclusion, car subscription services offer a flexible, convenient, and cost-effective alternative to traditional car ownership. With a wide variety of vehicles to choose from, all-inclusive pricing, and the freedom to cancel at any time, subscribers can enjoy the benefits of driving without the long-term commitment. So why wait? Join the car subscription movement today and experience a new way to drive.

Understanding the Benefits of Personal Injury Protection

In the realm of auto insurance, personal injury protection (PIP) stands out as a comprehensive coverage option designed to protect you and your passengers in the event of an accident. Let’s explore the various benefits that PIP offers and why it’s an essential component of your insurance policy.

Comprehensive Medical Coverage

One of the primary benefits of personal injury protection is its comprehensive medical coverage. In the event of an accident, PIP helps cover medical expenses for you and your passengers, regardless of who is at fault. This includes hospital bills, doctor’s fees, rehabilitation costs, and even lost wages due to injury-related time off work.

Coverage Beyond Health Insurance

While health insurance may cover some of your medical expenses in the event of an accident, it often comes with deductibles, co-pays, and coverage limits. Personal injury protection fills in the gaps left by health insurance, providing additional coverage for medical expenses that may not be fully covered by your health insurance policy.

Protection for You and Your Passengers

Personal injury protection extends coverage to all occupants of your vehicle, including yourself, your family members, and any passengers. This ensures that everyone in your vehicle is protected in the event of an accident, regardless of who is driving or who is at fault. With PIP in place, you can have peace of mind knowing that you and your loved ones are covered.

No-Fault Coverage

One of the unique features of personal injury protection is that it operates on a no-fault basis. This means that regardless of who caused the accident, your PIP coverage will kick in to cover your medical expenses. This can streamline the claims process and ensure that you receive prompt compensation for your injuries without having to wait for fault to be determined.

Protection Against Uninsured Drivers

In addition to providing coverage for accidents involving insured drivers, personal injury protection also offers protection against uninsured or underinsured motorists. If you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your medical expenses, PIP can help bridge the gap and ensure that you receive the care you need.

Customizable Coverage Options

Personal injury protection is highly customizable, allowing you to tailor your coverage to fit your individual needs and budget. You can adjust your coverage limits and deductibles to find a balance that provides adequate protection without breaking the bank. Working with an experienced insurance agent can help you navigate your options and find the right coverage for you.

Coverage for Non-Medical Expenses

In addition to medical expenses, personal injury protection may also cover non-medical expenses related to your injury, such as transportation costs to and from medical appointments, childcare expenses, and even household services that you’re unable to perform due to your injury. This comprehensive coverage ensures that you’re covered for all aspects of your recovery.

Peace of Mind on the Road

In conclusion, personal injury protection offers comprehensive coverage for you and your passengers in the event of an accident. Visit OffRoadTaxi.net to learn more about personal injury protection and explore your coverage options. With PIP in place, you can have peace of mind knowing that you’re protected against the financial consequences of an accident, allowing you to focus on your recovery.

Exploring the Significance of Underinsured Motorist Coverage

In the realm of auto insurance, underinsured motorist coverage plays a crucial role in protecting drivers against financial risks on the road. Let’s delve into the importance of underinsured motorist coverage and understand why it’s a vital component of your insurance policy.

Protecting Against Inadequate Coverage

Underinsured motorist coverage provides financial protection in the event that you’re involved in an accident with a driver whose insurance coverage is insufficient to cover the full extent of your damages. This coverage ensures that you’re not left bearing the financial burden of medical bills, vehicle repairs, and other expenses that exceed the at-fault driver’s coverage limits.

Filling the Gap Left by Underinsured Drivers

While liability insurance is mandatory for drivers in many states, not all drivers carry adequate coverage limits to fully compensate for the damages they may cause in an accident. Underinsured motorist coverage fills the gap left by underinsured drivers, offering you peace of mind knowing that you’re protected against the risks posed by insufficient insurance coverage.

Ensuring Comprehensive Protection

Accidents involving underinsured drivers can result in significant financial losses, especially if your medical expenses and vehicle repairs exceed the at-fault driver’s coverage limits. Underinsured motorist coverage ensures that you’re not left facing a hefty financial burden in the aftermath of such accidents, providing comprehensive protection for you and your passengers.

Covering Medical Expenses

In accidents involving underinsured motorists, medical expenses can quickly add up, especially if you or your passengers sustain serious injuries. Underinsured motorist coverage helps cover the cost of medical treatment for injuries sustained in the accident, ensuring that you receive the care you need without having to worry about the cost.

Protecting Your Finances

Underinsured motorist coverage also helps protect your finances by covering the cost of repairing or replacing your vehicle if it’s damaged in an accident with an underinsured driver. This ensures that you’re not left without transportation while waiting for repairs or dealing with the aftermath of a totaled vehicle.

Navigating Legal Complexities

Dealing with accidents involving underinsured motorists can be legally complex and time-consuming. Underinsured motorist coverage helps streamline the claims process by providing prompt compensation for your injuries and damages, allowing you to focus on your recovery rather than on legal battles.

Understanding Coverage Limits

When purchasing underinsured motorist coverage, it’s essential to understand your coverage limits. These limits represent the maximum amount your insurance company will pay for damages resulting from an accident with an underinsured motorist. It’s crucial to choose coverage limits that adequately protect your assets and financial well-being.

Tailoring Your Coverage

Underinsured motorist coverage is highly customizable, allowing you to tailor your coverage to fit your specific needs and budget. You can adjust your coverage limits and deductibles to find a balance that provides adequate protection without breaking the bank. Working with an experienced insurance agent can help you navigate your options and find the coverage that’s right for you.

Ensuring Peace of Mind

In conclusion, underinsured motorist coverage is a vital component of auto insurance, offering protection against the financial risks posed by underinsured drivers on the road. Visit OffRoadTaxi.net to learn more about underinsured motorist coverage and explore your options for ensuring peace of mind behind the wheel.

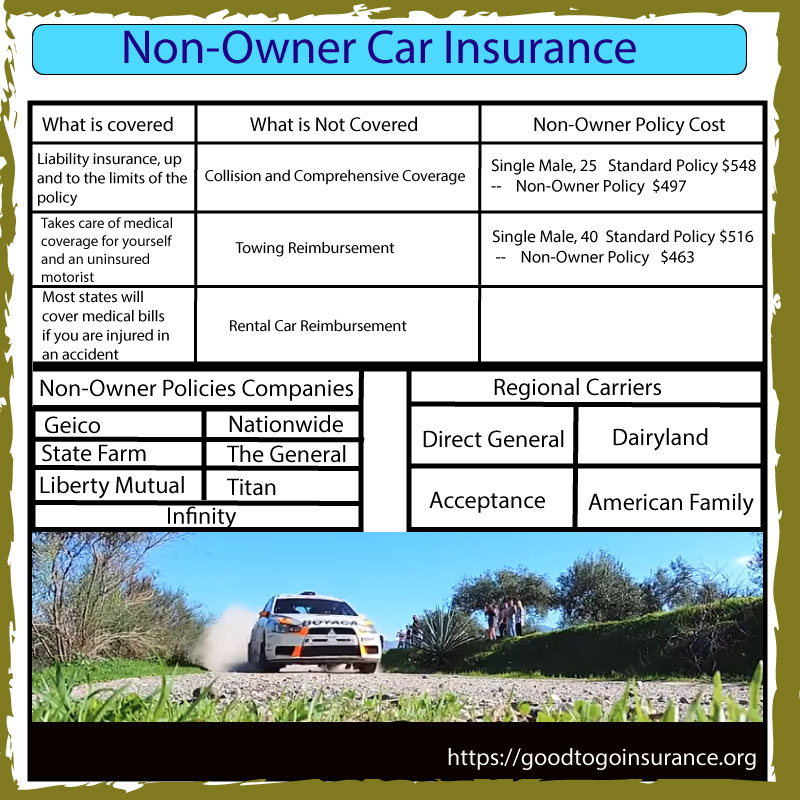

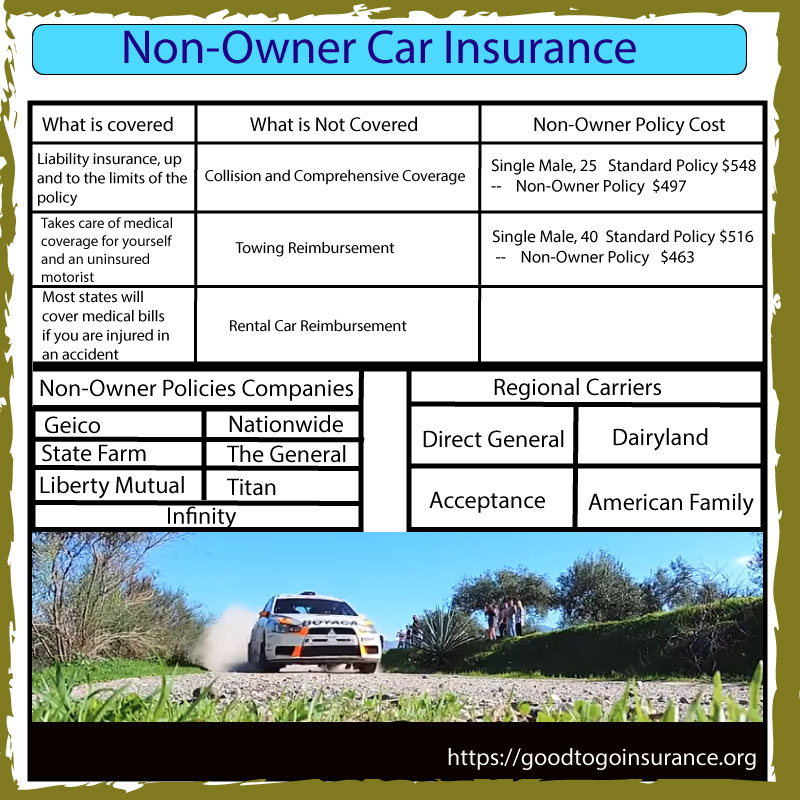

Non-Owner Car Insurance Coverage for Drivers without Vehicles

Rusty February 17, 2024 Article

Understanding Non-Owner Car Insurance

For individuals who don’t own a vehicle but still drive occasionally, non-owner car insurance provides a crucial layer of protection. Let’s delve into the specifics of non-owner car insurance and why it’s essential for drivers without their own vehicles.

Coverage for Non-Owners

Non-owner car insurance is designed to provide liability coverage for individuals who frequently borrow or rent vehicles but don’t have their own. This coverage ensures that you’re protected against potential liability claims if you’re involved in an accident while driving someone else’s car.

Filling the Gap

For drivers who don’t own a car, relying solely on the insurance coverage provided by the vehicle owner may not be sufficient. Non-owner car insurance fills this gap by providing additional liability coverage that extends beyond the vehicle owner’s policy, offering peace of mind for both the driver and the vehicle owner.

Meeting State Requirements

In many states, drivers are required to carry liability insurance, regardless of whether they own a vehicle. Non-owner car insurance helps ensure compliance with state insurance requirements, allowing you to legally operate a vehicle without the need for a personal auto insurance policy.

Protecting Your Finances

Accidents can happen, and being found liable for damages without adequate insurance coverage can have serious financial consequences. Non-owner car insurance protects your finances by providing coverage for bodily injury and property damage liability, ensuring that you’re not left facing exorbitant out-of-pocket expenses in the event of an accident.

Covering Rental Cars

Non-owner car insurance can also provide coverage when you rent a vehicle. Instead of purchasing insurance coverage from the rental car company, which can be expensive, you can rely on your non-owner car insurance policy to provide liability coverage while you’re behind the wheel of the rental car.

Understanding Limitations

It’s important to understand that non-owner car insurance typically does not provide coverage for damage to the vehicle you’re driving or for injuries you sustain in an accident. Instead, it focuses primarily on liability coverage for damages you may cause to others while driving a borrowed or rented vehicle.

Navigating Coverage Options

When purchasing non-owner car insurance, it’s essential to evaluate your coverage options carefully. While liability coverage is typically the primary focus, you may also have the option to add additional coverage, such as uninsured/underinsured motorist coverage or medical payments coverage, to enhance your protection.

Considering Cost Factors

The cost of non-owner car insurance can vary depending on factors such as your driving record, location, and coverage limits. While non-owner car insurance tends to be more affordable than standard auto insurance policies, it’s still important to shop around and compare quotes from multiple insurance providers to find the best rate.

Ensuring Peace of Mind

In conclusion, non-owner car insurance provides essential protection for individuals who frequently drive vehicles they don’t own. Visit OffRoadTaxi.net to learn more about non-owner car insurance and explore your options for coverage. With the right insurance policy in place, you can drive with confidence, knowing that you’re protected against potential liability claims.

Exploring the Convenience: Unlocking the Benefits of Weekly Car Rental

Flexible Mobility Solutions: The Appeal of Weekly Car Rentals

Weekly car rental services offer a convenient and flexible solution for individuals in need of temporary transportation. Whether you’re traveling for business or pleasure, relocating to a new city, or simply require a vehicle for a specific project or event, weekly car rentals provide the freedom to explore at your own pace without the commitment of a long-term lease or ownership.

Extended Exploration: The Advantage of Longer Rental Periods

Unlike daily rentals, which may be suitable for short trips or weekend getaways, weekly car rentals allow for more extended periods of exploration and travel. With a weekly rental, you have the flexibility to embark on longer road trips, visit multiple destinations, or immerse yourself in a new city for an extended stay. This extended timeframe provides ample opportunity to truly experience your destination and make the most of your time on the road.

Cost-Effective Solutions: Maximizing Value with Weekly Rentals

For travelers on a budget, weekly car rentals offer significant cost savings compared to daily or hourly rentals. By bundling multiple days into a single rental period, you can take advantage of discounted rates and enjoy more affordable transportation options. Whether you’re planning a week-long vacation or need a vehicle for an extended business trip, weekly car rentals provide a cost-effective solution that allows you to make the most of your travel budget.

Convenience and Efficiency: Streamlining the Rental Process

Weekly car rental services prioritize convenience and efficiency, making it easy for customers to book, pick up, and return their vehicles with minimal hassle. With online booking platforms and streamlined reservation processes, you can quickly secure your rental vehicle and hit the road in no time. Additionally, many rental companies offer flexible pickup and drop-off locations, allowing you to choose the most convenient option for your travel needs.

Freedom to Choose: A Diverse Fleet of Rental Vehicles

Weekly car rental services offer a diverse selection of vehicles to suit every preference and need. Whether you’re looking for a compact car for city driving, a spacious SUV for family vacations, or a luxury sedan for a special occasion, you’ll find a wide range of options available for weekly rental. With the freedom to choose the perfect vehicle for your trip, you can enjoy a comfortable and enjoyable driving experience wherever your travels take you.

Peace of Mind: Comprehensive Rental Coverage and Support

When you rent a car on a weekly basis, you can rest easy knowing that you’re covered by comprehensive rental insurance and roadside assistance services. From minor maintenance issues to unexpected emergencies on the road, rental companies provide support and assistance to ensure that your travel experience is safe, secure, and stress-free. With 24/7 customer service and dedicated support staff, you can enjoy peace of mind throughout your rental period.

Environmental Considerations: Sustainable Travel Options

For environmentally conscious travelers, weekly car rentals offer an eco-friendly alternative to traditional car ownership. By sharing vehicles with other customers and utilizing fuel-efficient rental options, you can minimize your carbon footprint and reduce the environmental impact of your travels. Additionally, many rental companies are investing in green initiatives and offering hybrid and electric vehicles as part of their rental fleets, providing sustainable transportation options for eco-conscious travelers.

Seize the Opportunity: Experience the Benefits of Weekly Car Rentals

Whether you’re embarking on a week-long adventure or need temporary transportation for an extended period, weekly car rentals offer convenience, flexibility, and affordability that make them an attractive option for travelers of all kinds. With the freedom to explore at your own pace, access to a diverse selection of vehicles, and peace of mind knowing that you’re covered by comprehensive rental coverage and support, weekly car rentals provide the perfect solution for your temporary transportation needs.

Weekly car rental services offer convenience, flexibility, and affordability for travelers in need of temporary transportation.

Unveiling the Benefits of Extended Warranty for Cars

Extended warranty for cars is a valuable option for buyers seeking additional protection and peace of mind beyond the standard manufacturer warranty. Let’s explore the advantages of extended warranty coverage and why it’s worth considering for your next vehicle purchase.

Understanding Extended Warranty Coverage

Extended warranty for cars, also known as vehicle service contracts, provides coverage for repairs and replacements of certain components and systems beyond the expiration of the manufacturer’s original warranty. This additional coverage can help mitigate the financial impact of unexpected repairs and breakdowns.

Comprehensive Protection

One of the key benefits of extended warranty coverage is its comprehensive protection against mechanical failures and defects. Extended warranties typically cover a wide range of components and systems, including the engine, transmission, electrical system, suspension, and more, providing buyers with peace of mind and assurance.

Flexibility in Coverage Options

Extended warranty plans come in various coverage levels and durations, allowing buyers to choose the option that best suits their needs and budget. Whether you prefer basic powertrain coverage or comprehensive bumper-to-bumper protection, there’s an extended warranty plan available to fit your requirements.

Cost-Effective Maintenance

By investing in an extended warranty for your car, you can avoid unexpected and potentially costly repair bills down the road. With coverage for major components and systems, extended warranties help spread out the cost of maintenance over time, making it easier to budget for vehicle ownership.

Transferability and Resale Value

Another advantage of extended warranty coverage is its transferability to subsequent owners, enhancing the resale value of your vehicle. Cars with extended warranty coverage are more attractive to potential buyers, as they provide assurance and protection against unforeseen expenses.

Manufacturer and Third-Party Options

Extended warranties are available from both manufacturers and third-party providers, each offering their own set of benefits and coverage options. Manufacturer warranties may offer factory-backed coverage and access to authorized service centers, while third-party warranties may provide more flexibility and customization.

Peace of Mind on the Road

With extended warranty coverage, you can enjoy peace of mind knowing that your vehicle is protected against unexpected repairs and breakdowns. Whether you’re commuting to work or embarking on a road trip, extended warranty coverage provides reassurance that help is just a phone call away in the event of a mechanical issue.

Enhanced Ownership Experience

Extended warranty coverage contributes to an enhanced ownership experience by minimizing the stress and uncertainty associated with vehicle maintenance and repairs. With coverage for major components and systems, you can drive with confidence knowing that your investment is safeguarded against unforeseen expenses.

Additional Benefits and Services

In addition to repair coverage, some extended warranty plans offer additional benefits and services, such as roadside assistance, rental car reimbursement, and trip interruption coverage. These value-added services further enhance the ownership experience and provide peace of mind on the road.

Conclusion

Extended warranty for cars is a valuable option for buyers seeking additional protection and peace of mind beyond the standard manufacturer warranty. With comprehensive coverage, flexibility in options, and peace of mind on the road, extended warranty coverage offers numerous benefits for car owners. Explore the world of extended warranty options and discover the right plan to safeguard your vehicle and your investment.

Endless Exploration Unlimited Mileage Car Rentals

Rusty February 2, 2024 Article

Absolutely, here’s the article:

Unlocking Boundless Adventures: Exploring Unlimited Mileage Car Rentals

Freedom to Explore

Unlimited mileage car rentals offer travelers the freedom to explore without constraints, allowing them to embark on epic adventures and traverse vast distances with ease. Whether embarking on a cross-country road trip, exploring scenic landscapes, or visiting multiple destinations within a single trip, unlimited mileage car rentals provide unparalleled flexibility for travelers seeking to expand their horizons and create unforgettable memories.

Endless Possibilities

With unlimited mileage car rentals, the possibilities are endless. Travelers can chart their own course and follow their wanderlust wherever it leads, without worrying about exceeding mileage limits or incurring additional fees. From scenic coastal drives to winding mountain roads, every mile traveled brings new discoveries and experiences to cherish, making each journey an adventure to remember.

Flexible Rental Agreements

Unlimited mileage car rentals typically come with flexible rental agreements that cater to the needs of travelers. Whether renting for a weekend getaway, a week-long vacation, or an extended road trip, travelers can enjoy the convenience of unlimited mileage without having to worry about restrictive rental terms or limitations on their travel plans. This flexibility allows travelers to tailor their rental experience to suit their individual needs and preferences.

Budget-Friendly Options

Contrary to popular belief, unlimited mileage car rentals are often more budget-friendly than their limited mileage counterparts. While some travelers may assume that unlimited mileage rentals come with higher rental rates, many rental companies offer competitive pricing and promotional deals for unlimited mileage rentals, making them an affordable option for travelers of all budgets. By comparing rates and taking advantage of special offers, travelers can enjoy the benefits of unlimited mileage without breaking the bank.

Peace of Mind

One of the greatest advantages of unlimited mileage car rentals is the peace of mind they provide. Travelers can focus on enjoying their journey without constantly monitoring their mileage or worrying about exceeding limits. Whether exploring remote destinations off the beaten path or simply cruising down scenic highways, unlimited mileage rentals allow travelers to relax and immerse themselves in the experience, knowing that their rental agreement offers unrestricted travel.

Planning Your Adventure

When booking an unlimited mileage car rental, it’s essential for travelers to plan their adventure carefully and consider their itinerary, budget, and rental needs. By outlining their travel plans in advance and booking a rental that aligns with their itinerary and budget, travelers can ensure a smooth and enjoyable rental experience from start to finish. Additionally, travelers should familiarize themselves with the rental company’s policies and procedures to avoid any surprises during their trip.

Exploring Off-the-Beaten-Path Destinations

Unlimited mileage car rentals open up a world of possibilities for travelers, allowing them to explore off-the-beaten-path destinations and discover hidden gems along the way. Whether venturing into remote wilderness areas, visiting quaint villages, or exploring lesser-known attractions, unlimited mileage rentals provide the freedom and flexibility to roam wherever curiosity leads. By venturing off the beaten path, travelers can uncover unique experiences and create memories that last a lifetime.

Embracing Spontaneity

One of the joys of unlimited mileage car rentals is the spontaneity they offer. Travelers can embrace the freedom to change course, explore new routes, and follow unexpected detours without worrying about mileage restrictions or penalties. Whether stumbling upon a charming roadside diner, stumbling upon a breathtaking viewpoint, or stumbling upon a local festival, travelers can embrace the unexpected and seize the moment, knowing that their unlimited mileage rental allows them to roam freely.

Creating Lasting Memories

At the end of the day, unlimited mileage car rentals are about more than just transportation – they’re about creating lasting memories and unforgettable experiences. Whether embarking on a solo adventure, traveling with loved ones, or exploring new destinations with friends, unlimited mileage rentals provide the opportunity to forge meaningful connections, discover hidden treasures, and make memories that will be cherished for years to come.

Embark on Your Adventure

With unlimited mileage car rentals, the world is yours to explore. Whether you’re planning a cross-country road trip, a scenic drive along the coast, or an off-the-beaten-path adventure, unlimited mileage rentals offer the freedom, flexibility, and peace of mind you need to make the most of your journey. So pack your bags, hit the road, and embark on your next adventure with unlimited mileage car rentals.

Categories

- Art & Entertaiment

- Auction Cars

- Auction Cars

- Auto

- Auto

- Auto Deal

- Auto Deal

- Auto Discount

- Auto Discount

- Auto Mobile

- Auto Mobile

- Auto24 De

- Auto24 De

- Automobile

- Automobile De Germany

- Automobile De Germany

- Automobile Deutschland

- Automobile Deutschland

- Automotive

- Bargain Cars

- Bargain Cars

- Business & Economic

- Business Product

- Business Service

- Car Auctions In Maryland

- Car Auctions In Maryland

- Car Auctions UK

- Car Auctions UK

- Car Book Value

- Car Book Value

- Car Specials

- Car Specials

- Cars

- Cheap

- Cheap Car Leasing

- Cheap Car Leasing

- Cheap Cars

- Cheap Cars

- Convertible

- Convertible

- Education & Science

- Fashion & Shopping

- Finance

- Food & Travel

- General Article

- Health

- Home

- Industry & Manufacture

- Inexpensive Cars

- Inexpensive Cars

- Law & Legal

- Military Auctions

- Military Auctions

- Mobile

- Mobile Auto

- Mobile Auto

- Parenting & Family

- Pet & Animal

- Real Estate & Construction

- Sport & Hobby

- Technology & SaaS

- Wholesale Cars

- Wholesale Cars

Recent Posts

- The New Face of Portraits Fresh Perspectives

- EQS SUV Price Guide Unveiling Mercedes’ Latest Offering

- Volvo Electric Driving Towards a Sustainable Future

- Bitcoin’s Future What’s Next for Crypto King?

- Introducing Tucson Hybrid Eco-Friendly SUV Innovation

- Unlocking Research New Grants for Academic Publishing

- DIY Halloween Costumes Creative & Budget-Friendly

- Understanding Modern Real Estate Finances

- Quality Control Analyst Ensuring Product Excellence

- Quality Control Specialist Your Path to a Secure Career

- Modern Furniture Fresh Styles for Your Home

- Ford Fusion Hybrid Redefining Efficient Driving Solutions

- Reimagined Still Life New Takes on the Classic

- Toyota Corolla Hybrid Efficient Eco-Friendly Driving

- Unveiling the Nissan Leaf Electric Revolution Begins

- Quality Control The Future of Music Production

- The Ultimate Guide to the Best EV Models Available Today

- Smart Fixed Income Navigating Today’s Market

- Nissan Leaf Pioneering Electric Mobility for Modern Drivers

- Chevrolet Blazer EV Electrifying Performance Unleashed