Exploring the Realm of Dealership Car Sales

When it comes to purchasing a new or used vehicle, dealership car sales are a common avenue for buyers to explore. Let’s dive into the world of dealership car sales, uncovering the process, benefits, and considerations involved in buying a car from a dealership.

The Dealership Experience

Walking into a dealership is like stepping into a hub of automotive expertise and opportunity. Dealerships offer a wide range of vehicles, from brand-new models to certified pre-owned options, providing buyers with a diverse selection to choose from.

Variety of Vehicles

One of the primary advantages of dealership car sales is the variety of vehicles available. Dealerships often carry vehicles from multiple manufacturers, offering different makes, models, trim levels, and features to suit every buyer’s preferences and budget.

New and Used Options

Whether you’re in the market for a brand-new car or a reliable used vehicle, dealerships have you covered. New car sales allow buyers to drive off the lot with the latest models, while used car sales offer affordable alternatives with lower price tags and certified quality assurance.

Financing Assistance

Navigating the world of car financing can be daunting, but dealerships offer financing assistance to streamline the process. Dealership finance departments work with buyers to secure competitive loan rates, tailor financing options to individual budgets, and expedite loan approval processes.

Trade-In Opportunities

If you’re looking to upgrade your current vehicle, dealership car sales present an opportunity to trade in your old car. Dealerships assess the value of your trade-in and apply it toward the purchase price of your new vehicle, making it easier to transition to a new ride.

Warranty and Service Benefits

Many dealership car sales come with warranty and service benefits, providing peace of mind and ongoing support for buyers. New car warranties cover manufacturer defects and repairs for a specified period, while certified pre-owned programs offer additional warranty coverage for used vehicles.

Test Drive Experience

Before committing to a purchase, dealerships allow buyers to test drive vehicles to ensure they meet their expectations. Test drives provide an opportunity to assess the car’s performance, comfort, and features firsthand, helping buyers make informed decisions about their purchase.

Professional Guidance

Throughout the car buying process, dealership staff provide professional guidance and assistance to buyers. Sales representatives offer product knowledge, answer questions, and guide buyers through the selection, financing, and purchasing steps with expertise and professionalism.

Transparent Pricing

Dealership car sales are known for their transparent pricing policies, ensuring buyers understand the costs associated with their purchase. Dealerships provide detailed pricing information upfront, including vehicle prices, taxes, fees, and financing terms, to facilitate informed decision-making.

Post-Purchase Support

Once the purchase is complete, dealerships continue to offer post-purchase support to buyers. Service departments provide maintenance and repair services, while parts departments offer genuine OEM parts and accessories to keep vehicles running smoothly.

Conclusion

Dealership car sales offer a comprehensive and convenient car buying experience, providing buyers with a wide selection of vehicles, financing assistance, trade-in opportunities, warranty coverage, and ongoing support. By exploring dealership car sales, buyers can find the perfect vehicle to suit their needs and preferences, backed by professional guidance and transparent pricing policies.

Navigating the Intricacies of SR-22 Insurance

In the realm of auto insurance, SR-22 insurance serves as a unique and often misunderstood requirement for drivers. Let’s delve into the intricacies of SR-22 insurance and understand its essentials for drivers navigating the roadways.

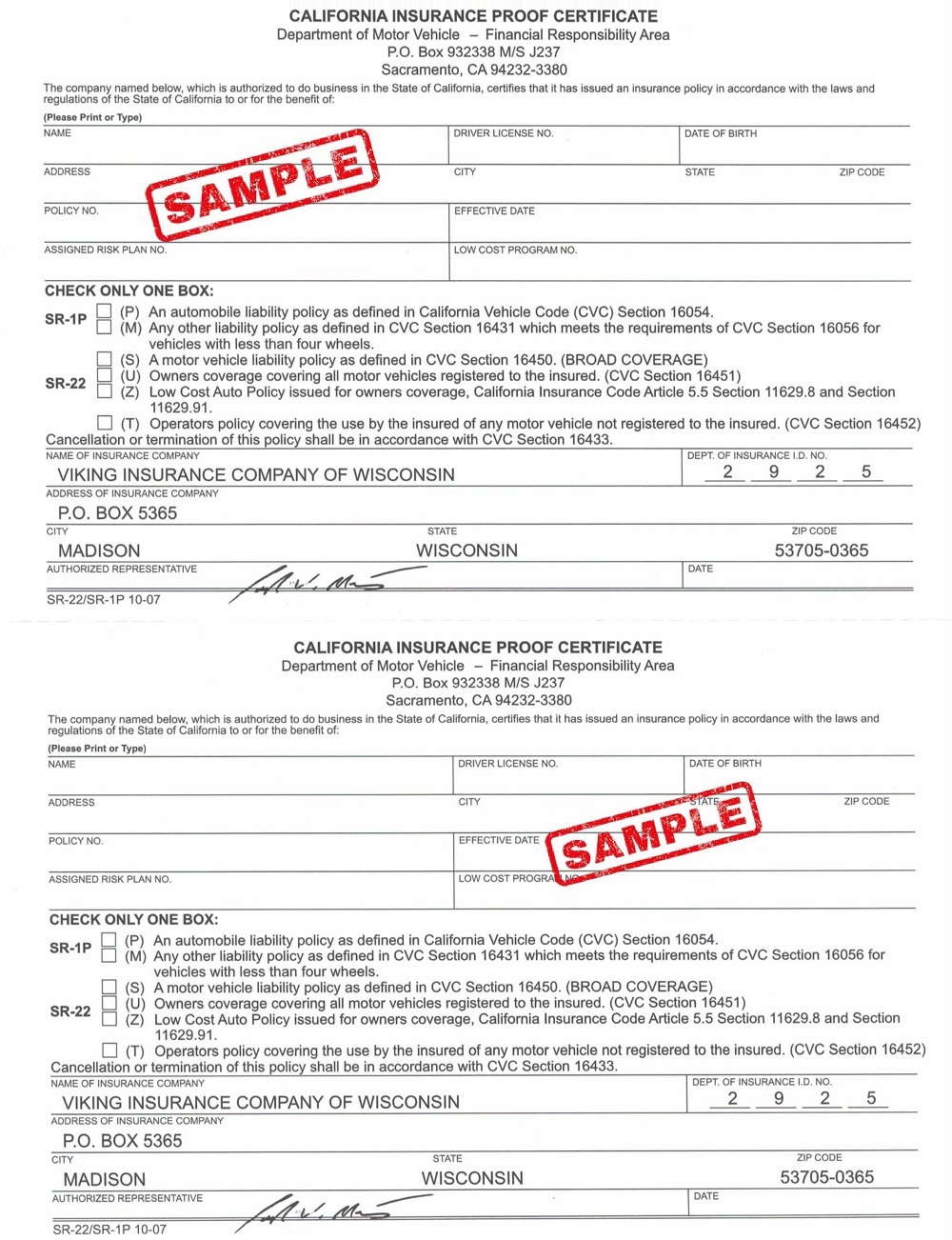

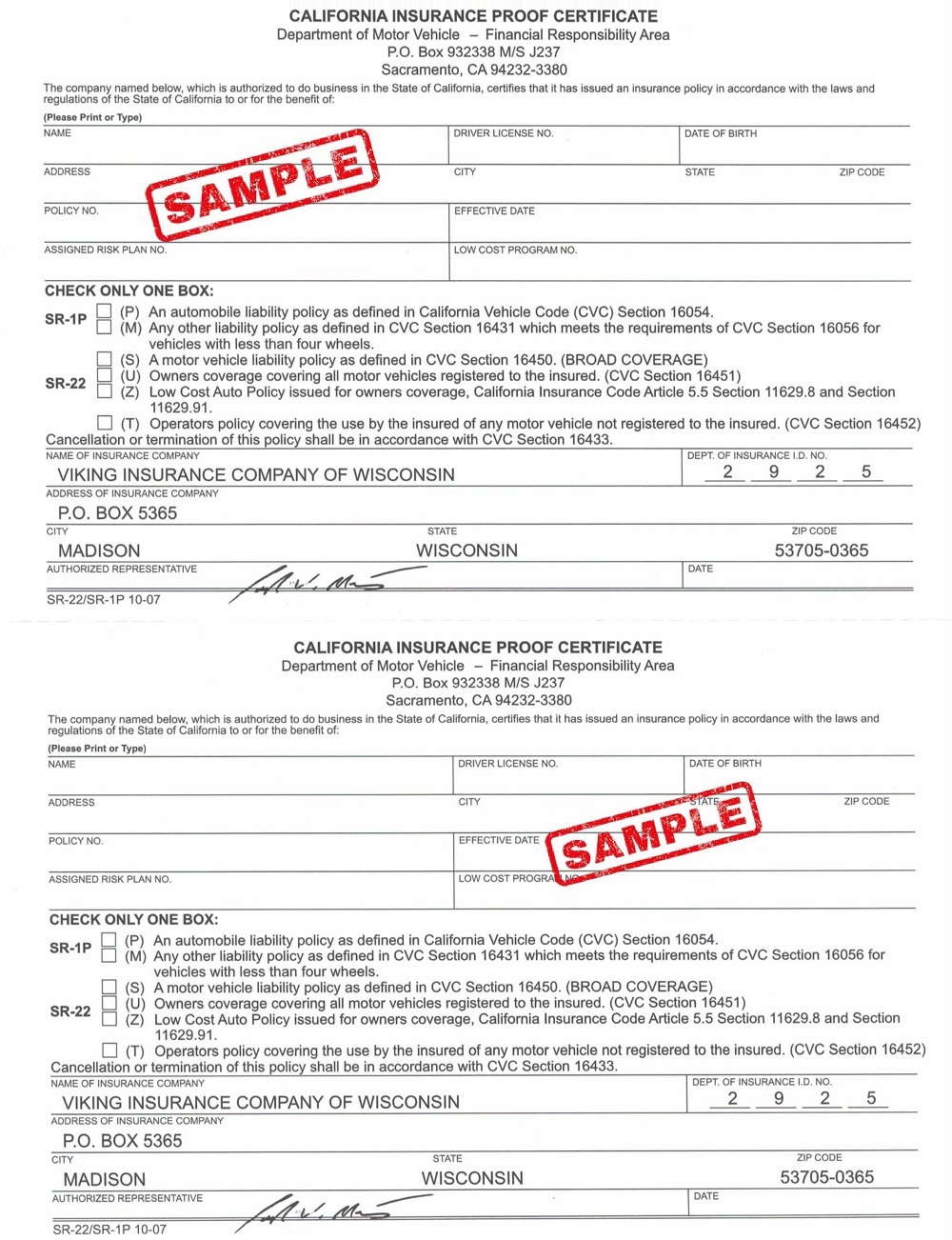

Understanding the SR-22 Requirement

SR-22 insurance is not actually a type of insurance policy, but rather a certificate filed by your insurance company with the state to verify that you have the minimum required auto insurance coverage. This requirement is typically mandated for drivers who have been convicted of certain traffic violations or offenses, such as DUIs or driving without insurance.

Reinstating Your Driving Privileges

For many drivers, obtaining SR-22 insurance is a necessary step to reinstate their driving privileges after a license suspension or revocation. The SR-22 certificate demonstrates to the state that you have met the minimum insurance requirements, allowing you to legally drive again. Without SR-22 insurance, you may be unable to regain your driving privileges.

Maintaining Compliance with State Laws

SR-22 insurance is often required for a specified period, typically ranging from one to three years, depending on the state and the nature of the offense. During this time, it’s crucial to maintain continuous coverage and avoid any lapses or cancellations in your insurance policy. Failure to comply with SR-22 requirements can result in further penalties and prolong the period of required filing.

Meeting Minimum Insurance Requirements

When obtaining SR-22 insurance, it’s essential to ensure that your policy meets the minimum insurance requirements mandated by the state. This typically includes liability coverage for bodily injury and property damage, as well as any additional coverage required by the state, such as uninsured motorist coverage. Working with an experienced insurance agent can help you navigate your options and find a policy that meets your needs.

Understanding the Cost Implications

Obtaining SR-22 insurance may come with additional costs beyond standard insurance premiums. Insurance companies may charge a filing fee to submit the SR-22 certificate to the state, and drivers with SR-22 requirements may face higher insurance premiums due to their increased risk profile. However, the cost of SR-22 insurance can vary depending on factors such as your driving record, age, and location.

Navigating the SR-22 Process

Navigating the SR-22 process can be daunting, especially for drivers who are unfamiliar with the requirements. It’s essential to understand your obligations under SR-22 insurance and ensure that you comply with all state regulations. Working with an experienced insurance agent can help simplify the process and ensure that you meet all necessary requirements.

Rebuilding Your Driving Record

While SR-22 insurance may seem like a burden, it can also serve as an opportunity to rebuild your driving record and demonstrate responsible behavior behind the wheel. By maintaining continuous coverage and avoiding further traffic violations, you can work towards improving your driving record and eventually regaining standard insurance rates.

Seeking Professional Guidance

In conclusion, SR-22 insurance is a unique requirement that can have significant implications for drivers. Visit OffRoadTaxi.net to learn more about SR-22 insurance and explore your options for meeting state requirements. With the right guidance and understanding, you can navigate the SR-22 process with confidence and ensure compliance with state laws.

Categories

- Art & Entertaiment

- Auction Cars

- Auction Cars

- Auto

- Auto

- Auto Deal

- Auto Deal

- Auto Discount

- Auto Discount

- Auto Mobile

- Auto Mobile

- Auto24 De

- Auto24 De

- Automobile

- Automobile De Germany

- Automobile De Germany

- Automobile Deutschland

- Automobile Deutschland

- Automotive

- Bargain Cars

- Bargain Cars

- Business & Economic

- Business Product

- Business Service

- Car Auctions In Maryland

- Car Auctions In Maryland

- Car Auctions UK

- Car Auctions UK

- Car Book Value

- Car Book Value

- Car Specials

- Car Specials

- Cars

- Cheap

- Cheap Car Leasing

- Cheap Car Leasing

- Cheap Cars

- Cheap Cars

- Convertible

- Convertible

- Education & Science

- Fashion & Shopping

- Finance

- Food & Travel

- General Article

- Health

- Home

- Industry & Manufacture

- Inexpensive Cars

- Inexpensive Cars

- Law & Legal

- Military Auctions

- Military Auctions

- Mobile

- Mobile Auto

- Mobile Auto

- Parenting & Family

- Pet & Animal

- Real Estate & Construction

- Sport & Hobby

- Technology & SaaS

- Wholesale Cars

- Wholesale Cars

Recent Posts

- Quality Control Analyst Ensuring Product Excellence

- Quality Control Specialist Your Path to a Secure Career

- Modern Furniture Fresh Styles for Your Home

- Ford Fusion Hybrid Redefining Efficient Driving Solutions

- Reimagined Still Life New Takes on the Classic

- Toyota Corolla Hybrid Efficient Eco-Friendly Driving

- Unveiling the Nissan Leaf Electric Revolution Begins

- Quality Control The Future of Music Production

- The Ultimate Guide to the Best EV Models Available Today

- Smart Fixed Income Navigating Today’s Market

- Nissan Leaf Pioneering Electric Mobility for Modern Drivers

- Chevrolet Blazer EV Electrifying Performance Unleashed

- Unlock Your Potential Our New Value Proposition

- Streamlining HR with SAP’s Latest Updates

- Discover Efficiency Honda Insight’s Eco-Friendly Performance

- Experience the Future of Healthcare with Umb

- Electric SUVs with the Most Advanced Tech Features

- Eco-Friendly Adventure Chevrolet Equinox EV Unveiled

- Transparent Supply Chains Why Are They Essential Today?

- Audi Hybrid SUV Redefining Luxury with Eco-Friendly Power